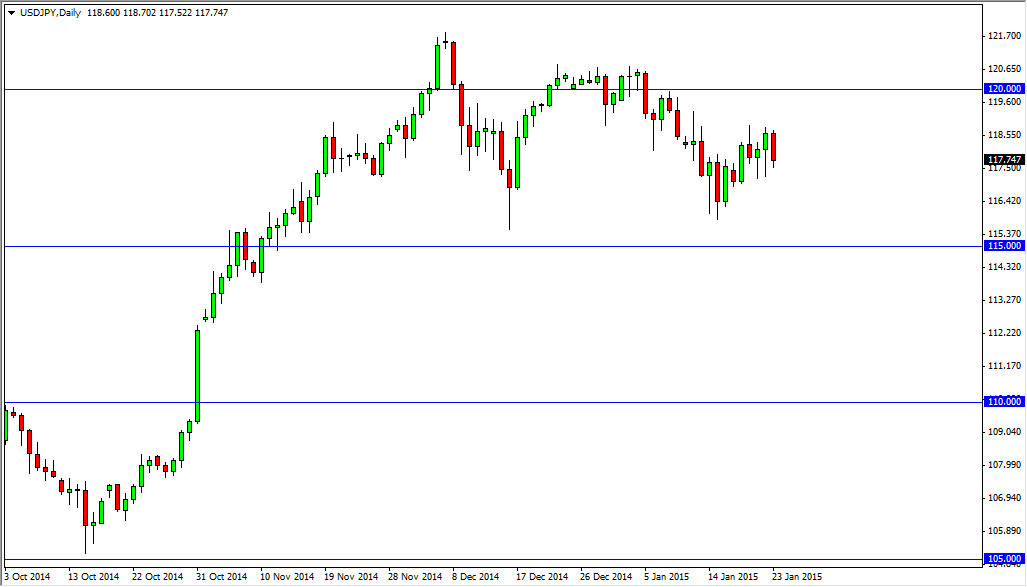

The USD/JPY pair fell during the course of the session on Friday, as the 118.50 level offered resistance. That being the case, it appears that the market should continue to grind in this general vicinity, as there seems to be a bit of confusion in the market at the moment. However, the 150 level below is the real support, so even a pullback here doesn’t have me thinking about selling this pair. After all, the pair is in a massive uptrend, and the central banks are complete polar opposites when it comes to the interest-rate policies. After all, the Bank of Japan continues to have an ultra-easy monetary policy in place, while the Federal Reserve of course has step away from quantitative easing, because of this, the longer-term interest-rate differential should continue to spread farther, and drive more money into the United States.

Buying dips as they appear

I’m still buying dips in this pair as they appear, as I believe we will ultimately break out to the upside. I believe that the next target will be 120, followed by the 122 level. If we can get above there, the market should then head to the 125 level without too many issues in my opinion. After all, the US dollar is the strongest currency in the world at the moment right now, and as a result I don’t have any interest in selling the US dollar in general, let alone against a currency whose bank is working so hard against it.

Ultimately, I recognize that we could go much higher, and believe that the longer-term uptrend is most certainly in play. I will continue to buy those dips going forward as they represent value in one of the most preferred currencies in the world. I believe that ultimately this pair goes as high as 125, and then much higher than that given enough time. It just seems now that the market will enter a longer-term “buy-and-hold” type of mentality given enough time but right now we get to chew through some of this volatility.