USD/JPY Signal Update

Last Wednesday’s signals expired without being triggered.

Today’s USD/JPY Signal

Risk 0.75%

Trades may be entered only before 5pm New York time, and then after 8am Tokyo time.

Long Trade 1

Go long following bullish price action on the H1 time frame immediately after the price first reaches 117.75.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

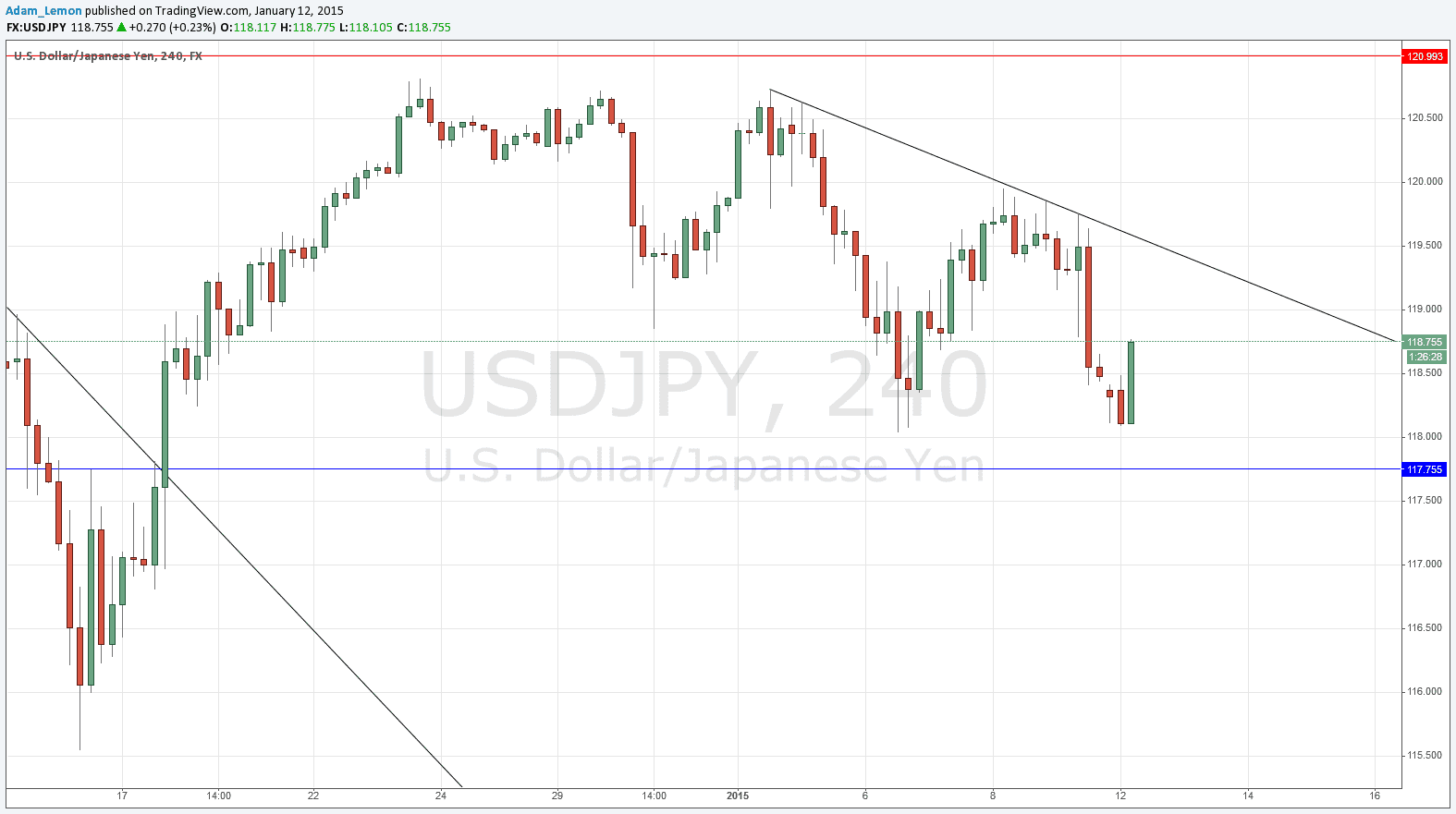

Go short following bearish price action on the H1 time frame immediately after the price first reaches the bearish trend line shown above the current price in the chart below.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/JPY Analysis

This pair has still not quite reached either of the key levels that I was talking about last week. It initially went sideways but has now fallen off due to a strengthening of the JPY, and earlier today it got quite close to the expected support level of 117.75.

The pair has been rising in early London trading today, suggesting that we are forming a double bottom a little way above the support at 117.75. However the recent failure to rise has also enabled us to draw a bearish trend line above. If the double bottom holds, the pair will complete a narrowing triangle formation.

We can look for a short trade off the bearish trend line above if confirmed by price action, and also a possible long trade off the expected support at 117.75.

There are no high-impact data releases scheduled today concerning either the JPY or the USD. It is likely to be a relatively quiet day today for this currency pair.