USD/JPY Signal Update

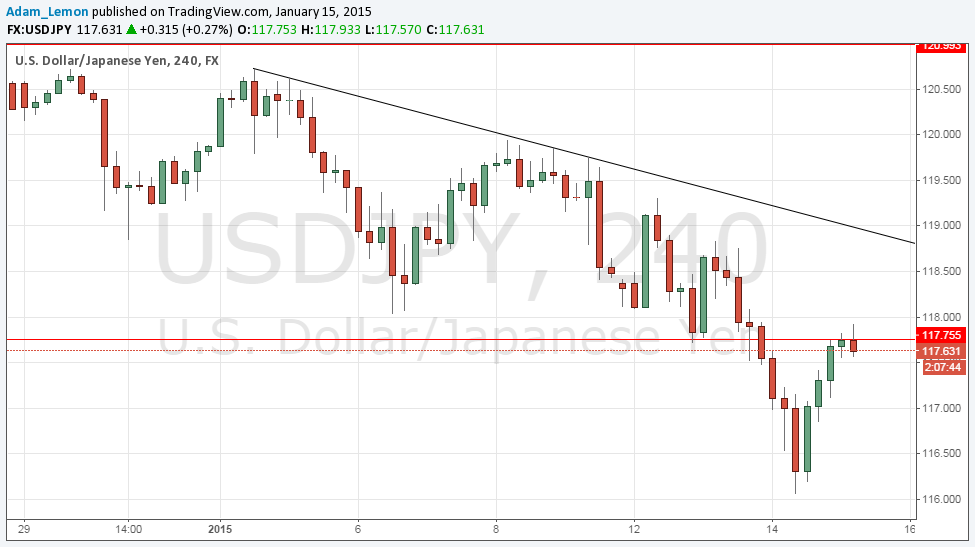

The possible outstanding long signal would have ended at breakeven on any remaining position, as the price fell back down to 117.75 and below before reaching the bearish trend line.

Today’s USD/JPY Signal

Risk 0.75%

Trades may be entered only before 5pm New York time, and then after 8am Tokyo time.

Short Trade 1

Go short following bearish price action on the H1 time frame immediately after the price first reaches the bearish trend line shown above the current price in the chart below.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/JPY Analysis

In my previous analysis I was identifying a consolidating triangle with support at 117.75. The support has since broken down, and showing signs of having flipped to resistance, so the triangle is over. The price is currently struggling to break up above 117.75, and its success or failure to do this will say something about the likely short-term direction of this pair. Although we have just had a fairly strong move up from a level close to 116.00, I see the true support sitting at around 115.00.

There are high-impact data releases scheduled today concerning the USD. At 1:30pm London time there will be releases of U.S. PPI and Unemployment Claims data, followed by the Philly Fed Manufacturing Index at 3pm. Later at 4:15pm, the President of the German BUBA will be speaking. Therefore the New York session will probably see this pair quite active.