USD/JPY Signal Update

Last Thursday’s signal expired without being triggered, as the price never reached the bearish trend line.

Today’s USD/JPY Signal

Risk 0.75%

Trades may be entered only before 5pm New York time, and then after 8am Tokyo time.

Short Trade 1

Short entry following bearish price action on the H1 time frame immediately after the price first reaches 117.75

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 2

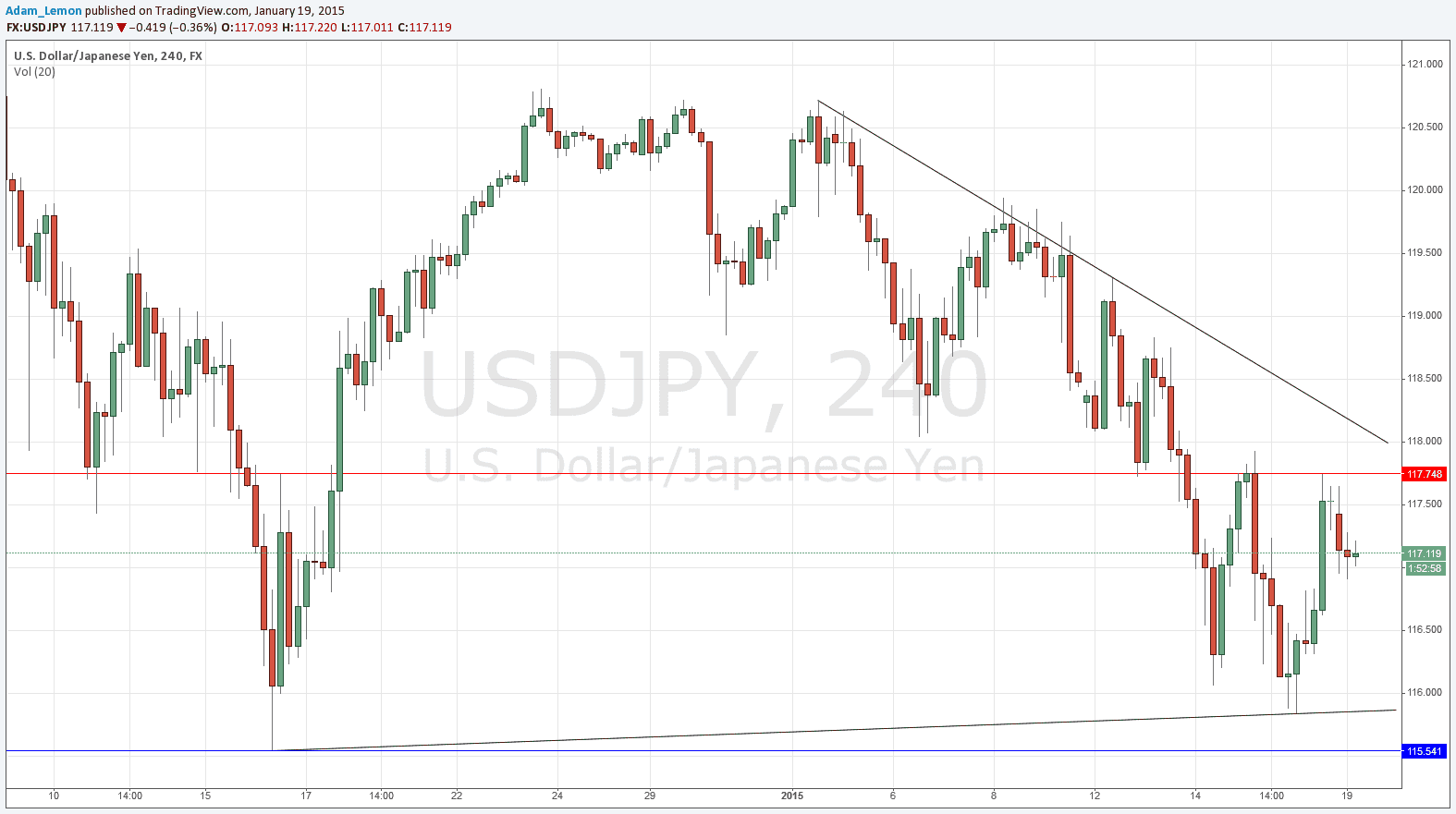

Short entry following bearish price action on the H1 time frame immediately after the price first reaches the bearish trend line shown above the current price in the chart below.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 1

Long entry following bearish price action on the H1 time frame immediately after the price first reaches 115.54

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/JPY Analysis

I wrote last Thursday that the pair was struggling to break up above 117.75 and that if the price failed to do so, it would suggest that over the short term at least the price is going down. This seems to be the case, but there is strong support below at 115.54. As we chop around between these two levels, we are gradually forming a new consolidating triangle. There is a bearish trend line which is approaching the current price, and this may increase the downwards pressure. On the other hand, should we break above that confluence, it would be a bullish sign.

It is very unlikely that any levels will break before the later Tokyo session, at the earliest.

There are no high-impact data releases scheduled today concerning either the JPY or the USD. It is a public holiday in the USA. Therefore it is likely that today will be a relatively quiet day for this pair, especially before 8am Tokyo time.