USD/JPY Signal Update

Yesterday’s signal expired without being triggered, as although the price did begin to turn short when it first reached 117.75, it did not print strongly bearish price action on the H1 chart.

Today’s USD/JPY Signal

Risk 0.20%

Trades may be entered only between 8am and 5pm New York time, and then after 8am Tokyo time later.

Short Trade 1

Go short following bearish price action on the H1 time frame immediately after the price first reaches 119.94

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 1

Go long following bullish price action on the H1 time frame immediately after the price first retests 117.75.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

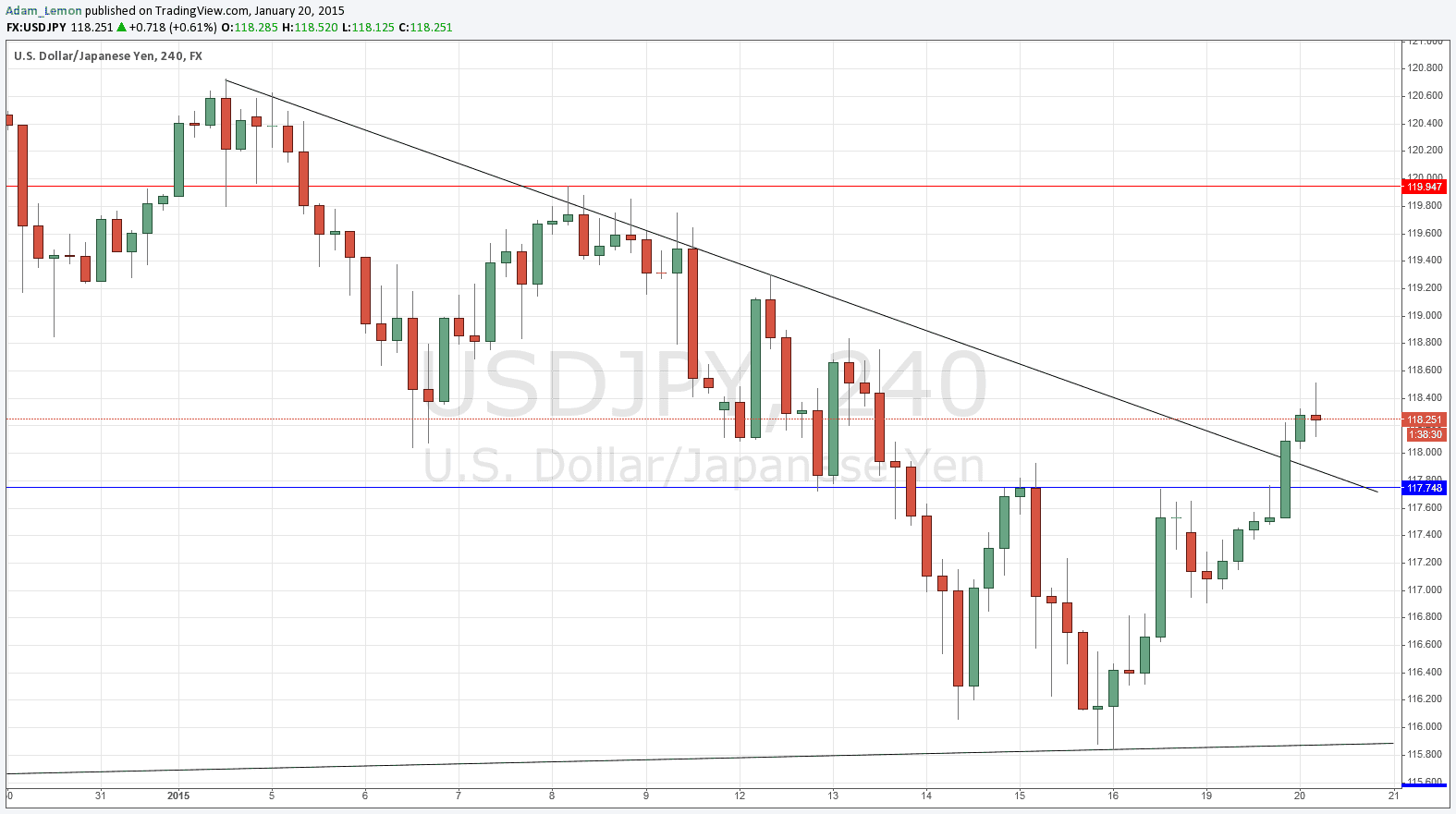

USD/JPY Analysis

I wrote yesterday that if we can break above the bearish trend line and horizontal resistance that were becoming confluent at around the 117.75 it would be a bullish sign. We have had that break out now although it is relatively weak. However if we now get a pull back to the 117.75 level again, which is now even more confluent with the broken trend line, it could be a good launching pad for a stronger rise in price. Therefore I am looking for a long opportunity there, but not before the New York open as it would be too soon to get long again this morning.

Above, there is flipped support to resistance likely at 119.94, and this is nicely confluent with a very round, whole and psychologically important number at 120.00, so it should hold enough to be a good level at which to look for a short trade.

Looking at longer term charts, it seems that this pair is really just consolidating, so I am not expecting renewed strong momentum that will push this pair significantly above 120.00 any time soon.

There are no high-impact data releases scheduled today concerning the USD, however there is expected to be a Bank of Japan Monetary Policy Statement late in the Tokyo session that may affect the JPY. Therefore it is likely that today will be a relatively quiet day for this pair, at least until the second half of the Tokyo session.