USD/JPY Signal Update

Yesterday's signal was not triggered and expired.

Today’s USD/JPY Signal

Risk 0.25%

Trades may be entered only between 8am and 5pm New York time, and then after 8am Tokyo time later.

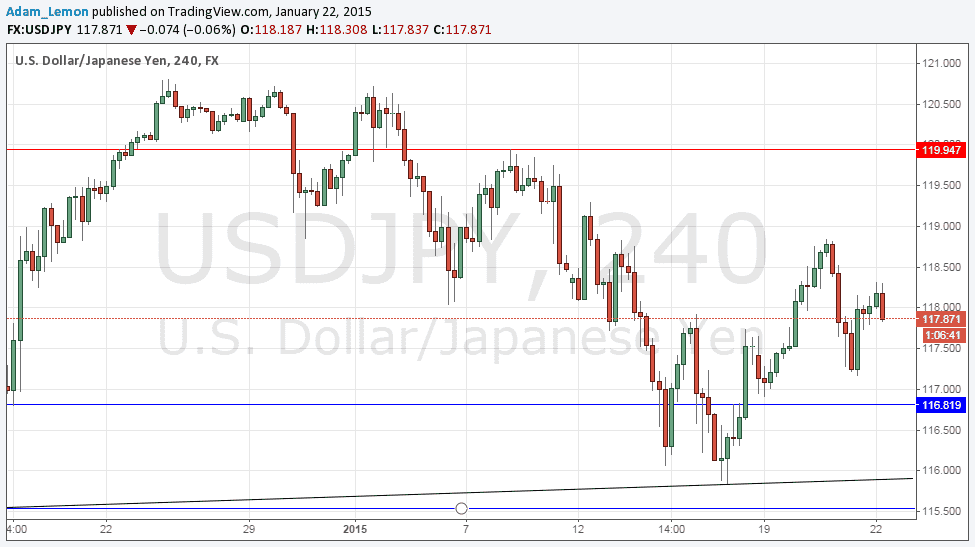

Long Trade 1

Go long following bullish price action on the H1 time frame immediately after the price first reaches 116.82, but no entry should be made above 117.25.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 25 pips in profit.

Take off 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to ride.

Long Trade 2

Go long following bullish price action on the H1 time frame immediately after the price first reaches 115.54, but no entry should be made above 116.10.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 25 pips in profit.

Take off 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to ride.

Short Trade 1

Go short following bearish price action on the H1 time frame immediately after the price first reaches 119.94, but no entry should be made below 119.40.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 25 pips in profit.

Take off 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to ride.

USD/JPY Analysis

This pair moved up yesterday in line with the general strengthening of the USD but was certainly not one of the market highlights. No key levels were touched. Technically it looks like we are in a consolidation albeit still one with some fairly clean and wide swings that can be worth trading, at least to day traders. There are key support and resistance levels both above and below that may provide good trading opportunities if confirmed by price action, most probably only after the ECB press conference shortly after New York opens.

There are no high-impact data releases scheduled today directly concerning the USD or the JPY, but it will be a huge news day for the EUR. At 12:45pm London time the ECB will announce the Minimum Bid Rate. At 1:30pm the ECB will open a press conference in which they are expected to announce the launch of a detailed program of Quantitative Easing. This is highly likely to have an impact upon the entire Forex market.