USD/JPY Signal Update

Last Thursday’s signals expired without being triggered.

Today’s USD/JPY Signal

Risk 0.75%

Trades may be entered only between 8am and 5pm New York time, and then after 8am Tokyo time later.

Long Trade 1

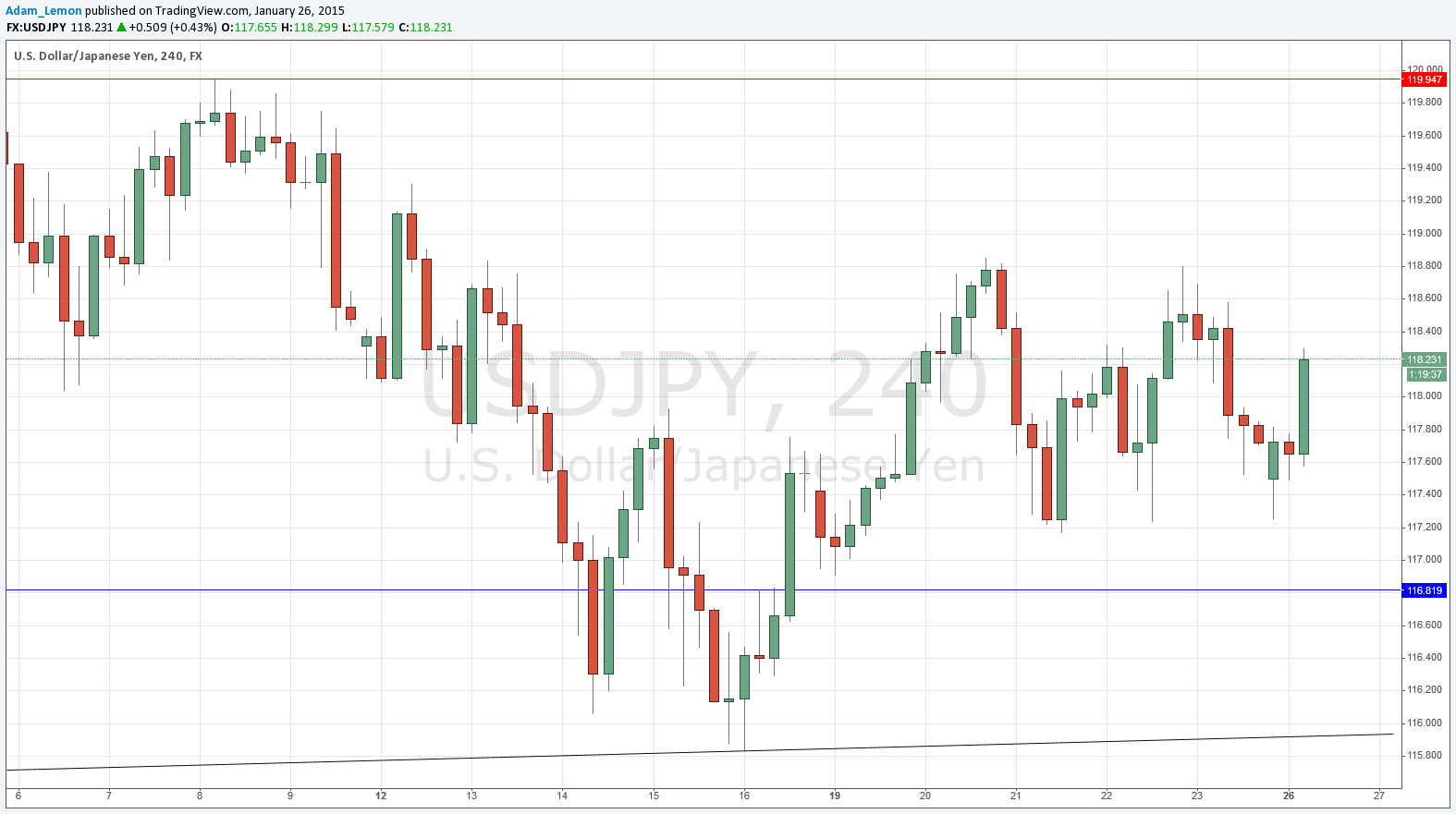

Long entry following bullish price action on the H1 time frame immediately after the price first reaches 116.82.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

Short entry following bearish price action on the H1 time frame immediately after the price first reaches 119.94.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 25 pips in profit.

Remove 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to run.

USD/JPY Analysis

In spite of all the turmoil in the Forex market over the past few days, this pair has been relatively unchanged, with both the USD and the JPY showing some strength and effectively balancing each other out.

The chart does suggest we have a slight upwards trend, and we still have fairly clear waves which makes this pair a good candidate for range trading, if that is what you like.

I see the same key levels from last week as being of interest for potential reversals. The double top at 118.80 could also be a significant level if and when it is next tested.

There are no high-impact data releases scheduled today directly concerning the USD or the JPY, therefore it is quite likely to be a relatively quiet day for this pair.