USD/JPY Signal Update

Yesterday’s signals were not triggered and expired as the price never reached either 116.82 or 119.94.

Today’s USD/JPY Signal

Risk 0.75%

Trades may be entered only between 8am and 5pm New York time, and then after 8am Tokyo time later.

Long Trade 1

Go long following bullish price action on the H1 time frame immediately after the price first reaches 116.82.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

Go short following bearish price action on the H1 time frame immediately after the price first reaches 119.94.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 25 pips in profit.

Take off 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to ride.

USD/JPY Analysis

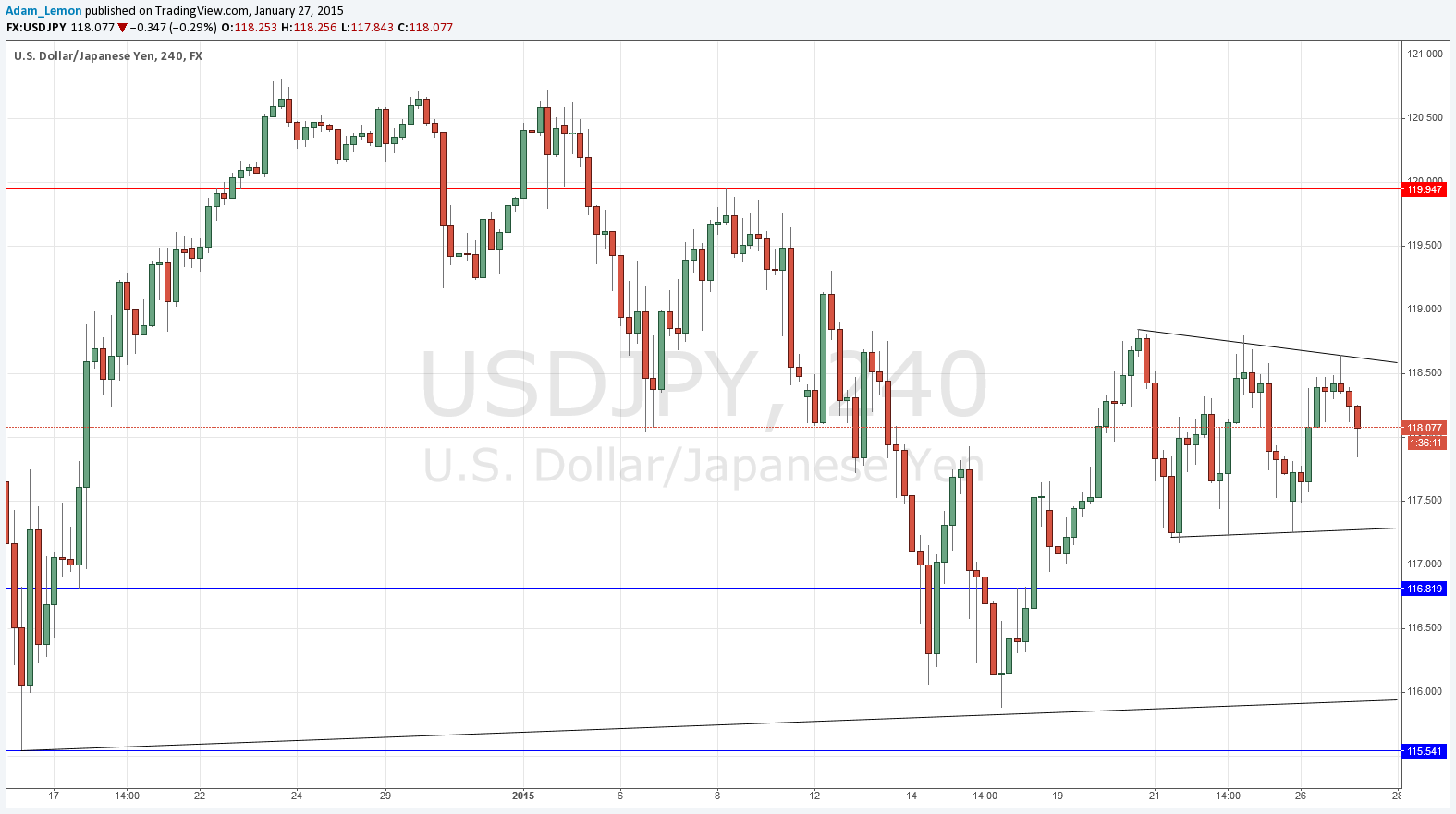

The pair remains unchanged, stuck in a consolidation pattern within a consolidation pattern, as shown in the chart below. Which side of the current triangle the price breaks out of first may provide a clue as to whether we are going to see 119.94 before 116.82 or not.

It is interesting that we cannot really draw a clear upper bearish trend line. This suggests technically that the dominant trend is still upwards, so a chance to get long at around 116.82 might be an exciting opportunity, albeit one that could take a long time to come to fruition.

There are no high-impact data releases scheduled today concerning the JPY, but there are regarding the USD. At 1:30pm London time there will be a release of U.S. Core Durable Goods Orders data followed by CB Consumer Confidence and New Home Sales at 3pm. Therefore the most volatile period for this pair is likely to occur during the New York / London overlap.