USD/JPY Signal Update

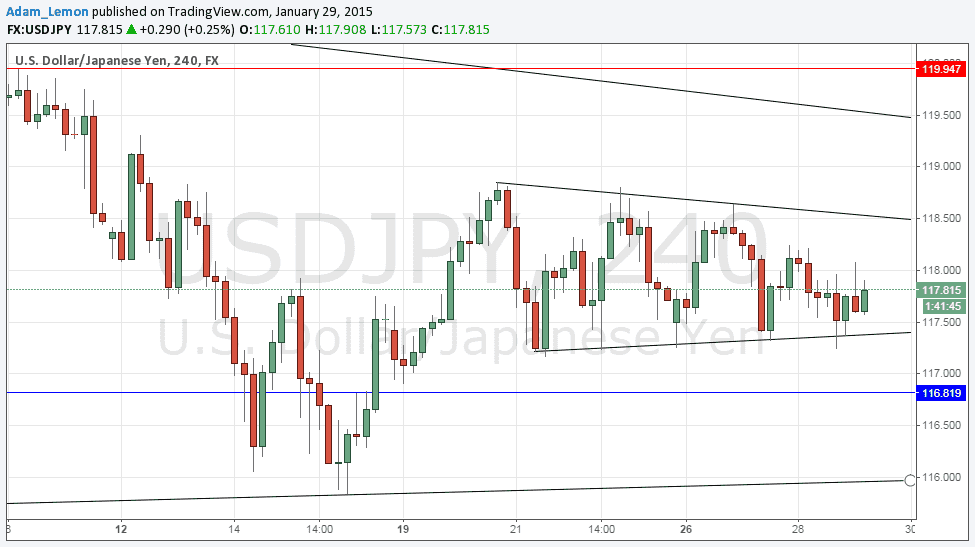

Yesterday’s signals were not triggered as the price has still not reached either 116.82 or 119.94.

Today’s USD/JPY Signal

Risk 0.75%

Trades may be entered only between 8am London time and 5pm New York time, and then after 8am Tokyo time later.

Long Trade 1

Go long following bullish price action on the H1 time frame immediately after the price first reaches 116.82.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

Go short following bearish price action on the H1 time frame immediately after the price first reaches 119.94.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 25 pips in profit.

Take off 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to ride.

USD/JPY Analysis

It is surprising that even following yesterday's FOMC announcement, which did move the USD around at least a little, this pair has remained firmly stuck within a consolidating triangle within a larger consolidating triangle. Something has to break long or short at some point, but we are not quite there yet. Therefore yesterday's analysis still stands: the first proper break of the small triangle will probably indicated which level is going to be hit next.

There are no high-impact data releases scheduled today concerning the JPY, but there is one regarding the USD. At 1:30pm London time there will be a release of Unemployment Claims data.