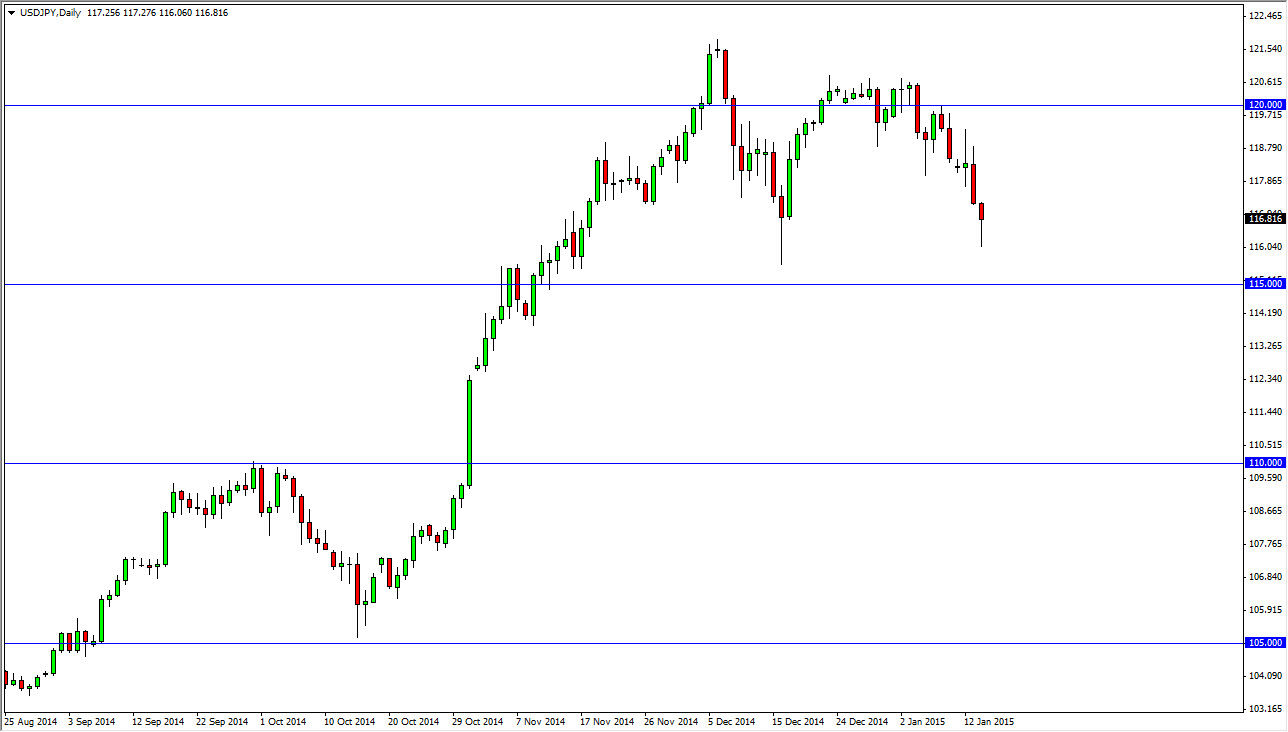

The USD/JPY pair initially fell during the session on Wednesday, but found enough support at the 160 level to turn things back around for a bit of a hammer. The hammer of course is a very positive sign, and the fact that we are at the lower reaches of the most recent consolidation area does of course attract my attention. I have no plans whatsoever on selling this pair anyway, and any time we formed a potential buying opportunity it of course catches my eye.

I believe that if we can break above the top of the hammer for the session on Wednesday, it is in fact a buying opportunity. I don’t see any reason why we wouldn’t go back to the 120 handle, and perhaps just a little bit above there. Ultimately, I do think that this pair breaks out to the upside and we continue to much higher, but we could have a little bit of grinding to do over the course of the month of January.

Continuing to buy the dips

I am personally continuing to buy the dips in this pair, simply because I believe that we go much higher. I think that we eventually go to the 125 level over the course of the next several months. We may not have the impulsive moves that we had had recently, but at the end of the day I think that this is a longer-term opportunity and will make quite a bit of money for the trader whose willing to not only hang onto the volatility and to the trade itself, but must be willing to add in small increments to a longer-term position.

I believe that the 115 level is the floor at the moment, and even if we broke below there it’s not until we break down below 110 that I would consider the trend changing to the downside. Ultimately though, I don’t see that happening and with that I am extraordinarily bullish of this pair and have been for several months.