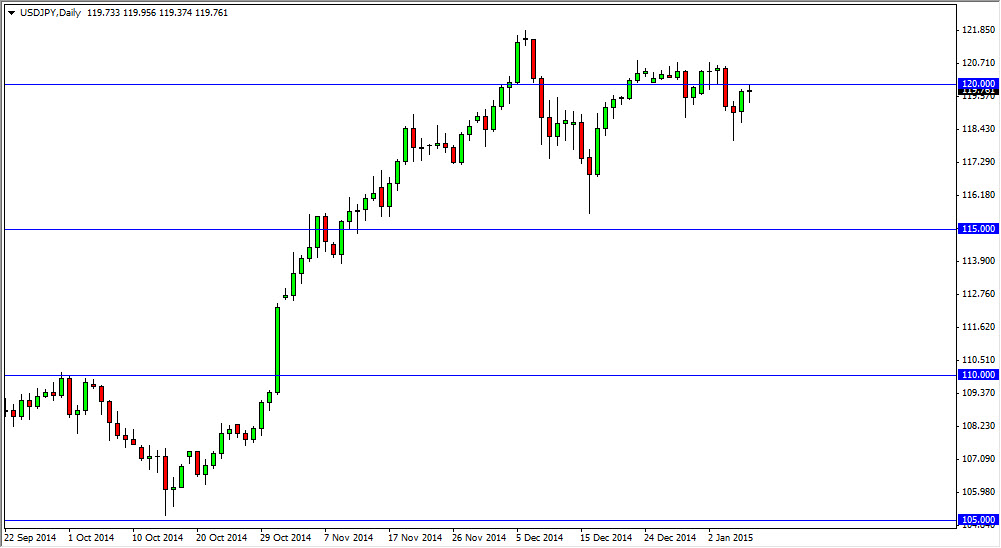

The USD/JPY pair went back and forth during the course of the day on Thursday, as we press up against the 120 level. This is an area that the market has been attracted to for some time now, so it’s not surprising to find a sitting right here right before the nonfarm payroll announcement comes out. With that, I believe that there is still one direction in this market, and that’s higher. However, that may not be today and you have to be cognizant of the fact that a less than stellar jobs number coming out of the United States might actually make this market pullback drastically, but ultimately I believe that is simply going to be an opportunity to buy the US dollar cheaply.

The 115 level below is massively supportive, and I believe essentially the “floor” in this market. It’s only a matter time before the buyers step in, so the question then becomes whether or not we need a pullback to that area in order to find them, or if they will show up right away?

Longer-term uptrend should stay in place

The longer-term uptrend should continue to stand place, as the industry differential should continue to expand. After all, the Bank of Japan is still looking to keep a very loose monetary policy, essentially driving down the value of the Yen. With that, this market should continue to go higher, as the US dollar has the Federal Reserve backing it with its into quantitative easing. On top of that, the market looks as if every time it falls, buyers step back in so I don’t see that changing anytime soon. Quite frankly, I would love to see this market turned back around and drop three or 400 pips. To me that’s just a nice opportunity to take advantage of a temporary moment.

I believe that this is a longer-term uptrend, and will continue for several years. With that, it’s only a matter of time before we reach the 125 level in my opinion.