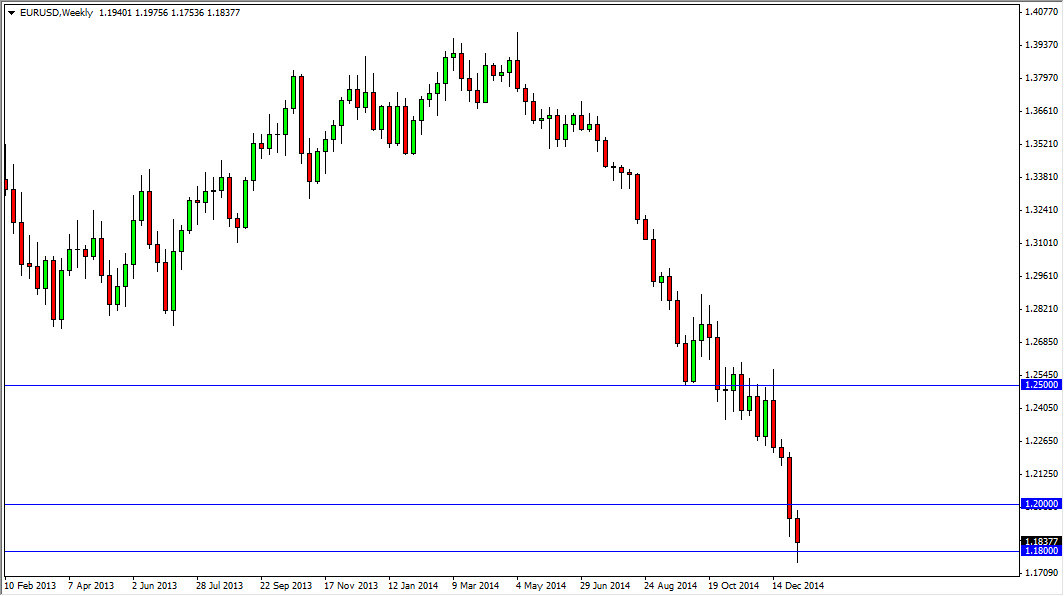

EUR/USD

The EUR/USD pair spent most of the week falling, but did find enough support below the 1.18 level to turn things back around and form a little bit of a hammer. Is in this area that I would anticipate a potential trend change, so the fact that we did this does in fact interest me I’m not quite ready to start buying yet, but I do recognize that on the daily charts we have formed two hammers in a row. If we break above the 1.20 level, I think we could go to the 1.2350 level first, and then ultimately test the 1.25 handle. Either way, the Euro is oversold.

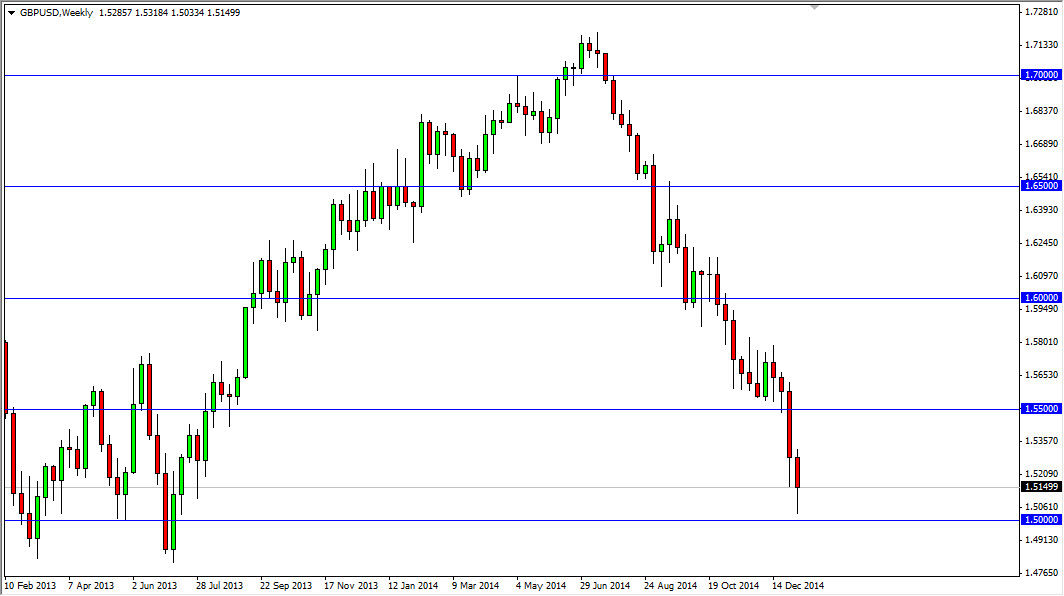

GBP/USD

The GBP/USD pair acted almost identical to the EUR/USD pair during the week, falling all the way to roughly the 1.50 handle. In that region, we found buyers and as a result we ended up bouncing enough to form a hammer. The hammer of course is a very positive sign, so I think that the market will continue to go higher from here given enough time. I don’t have any interest in selling this market anymore, as I believe that the market is probably finding serious support in this area. In fact, I think there is massive support all the way down to the 1.48 handle, meaning that I fully anticipate to see a bounce.

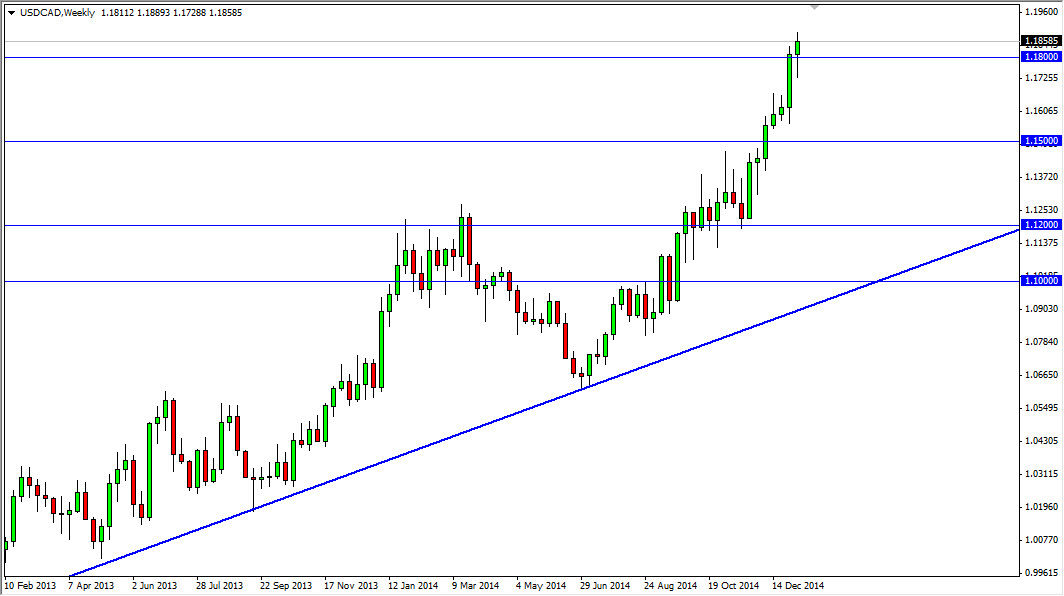

USD/CAD

The US dollar initially fell against the Canadian dollar this week, but as you can see found enough support below the 1.18 level to turn things back around. The candle ultimately ended up being a hammer, which of course is a very positive sign. A hammer at the top of an uptrend shows that there is still plenty of buying pressure below. However, if you break the bottom of that hammer that it becomes what is known as a “hanging man.” This is a very negative sign. If that happens though, I think that there is plenty of support below that I will simply wait for another supportive candle to start buying.

USD/JPY

The USD/JPY pair had a fairly negative week, but as you can see we still have plenty of support below. Quite frankly, the pullback was in and of DB2 concerned, so now I’m just simply waiting on supportive candles in order to start buying what I would consider to value in the US dollar. Ultimately, I think that the market goes much higher, and that pullbacks will continue to be buying opportunities. In fact, I have absolutely no scenario in which were willing to sell this pair right now.