EUR/GBP

The EUR/GBP pair fell during the course of the week, as the Euro got beat down against almost everything on the planet. The fact that we closed below the 0.7750 level shows that there is serious weakness in this pair, and as a result I believe that rallies will continue to be selling opportunities this week. However, I am aware of the fact that we could in fact bounce all the way back to the 0.7750 level in order to test that area for resistance. Nonetheless, I remain bearish and have no interest in buying this pair at all.

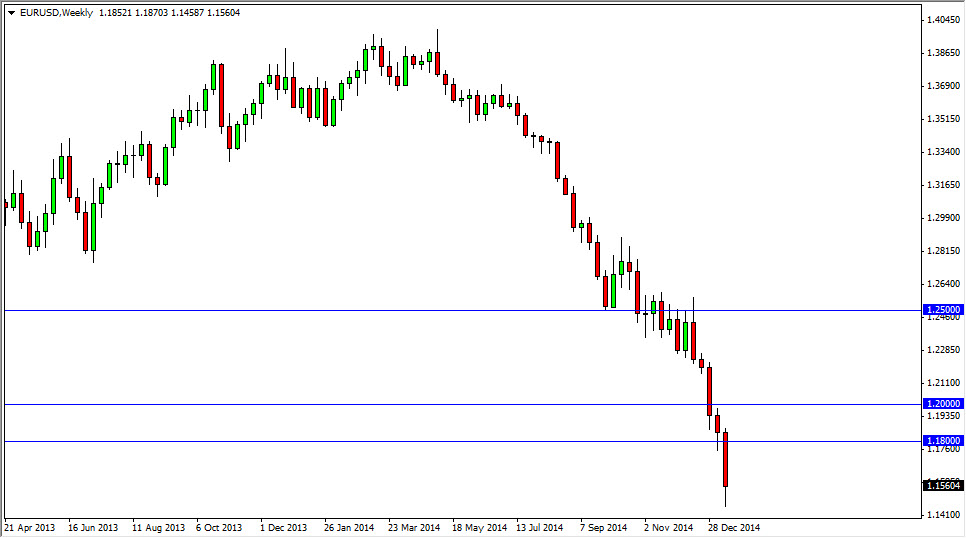

EUR/USD

The EUR/USD pair broke down during the course of the week as well, slicing through the 1.18 support level. That being the case, we ran all the way down to the 1.15 handle where we found a bit of support during the session on Friday. The 1.15 level course is a large, round, psychologically significant number, so it is likely that a lot of profit taking may have been found down there. I believe that this is a lot like the EUR/GBP pair, in the sense that you are looking for short-term rallies in order to continue selling.

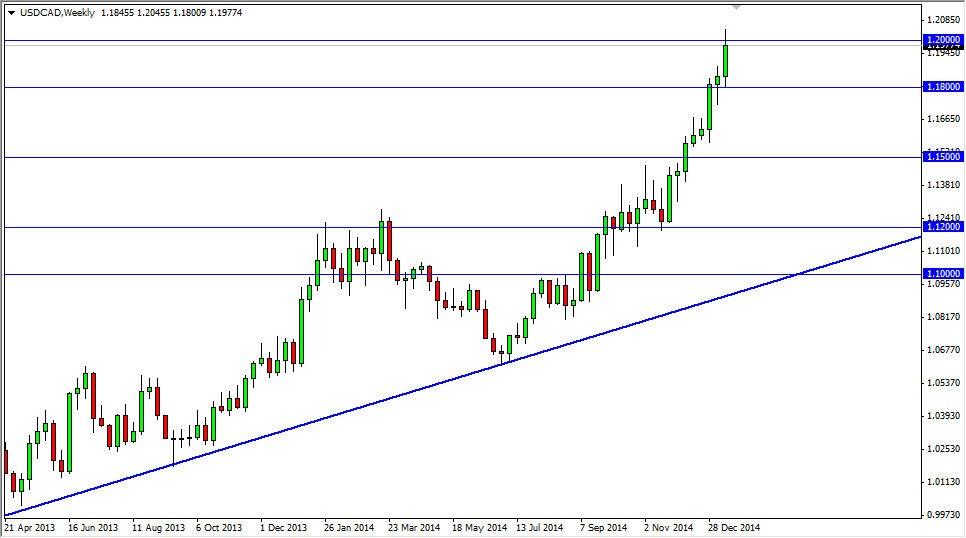

USD/CAD

The USD/CAD pair broke above the 1.20 level during the course of the week, which of course is a fairly bullish sign. However, we pulled back and formed a shooting star during the Friday session which suggests that the market isn’t quite ready to break out yet. Nonetheless, pullbacks to the 1.18 level are buying opportunities as far as I can see, some looking for supportive candles on shorter-term charts in order to go long as this market should ultimately build up enough momentum to break out to the upside.

USD/JPY

The USD/JPY pair had a fairly volatile week, ultimately settling on something along the lines of a hammer. I still believe that this market continues to go much higher, but we may need to grind sideways for a while as the impulsive move higher certainly was a bit overdone. With that, I am buying dips but I also recognize that the 120 level is probably going to be the beginning of significant resistance and therefore I am aiming for short-term gains only at this point in time. Ultimately though, I think that we do break out above the high and head to the 125 handle next.