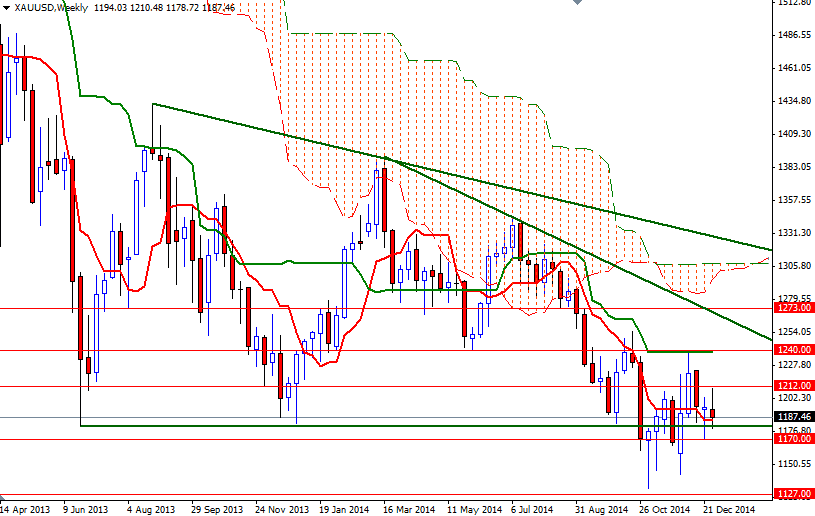

Gold prices fell on the final trading day of 2014, notching its second consecutive annual drop, as gains in the dollar sapped safe-haven demand. The precious metal closed down roughly 1.6% for 2014, compared with the December 31, 2013 settlement price of $1206.80 per ounce. Geopolitical concerns and sharp drops in the global equities were the main drivers of the surge in gold investment during the first quarter but the gains linked to the safe-haven buying were not sustainable. As a result the market failed to hold on to gains and eventually slumped to $1131.96, the lowest level since April 2010.

Gold has come under renewed pressure in recent weeks, as investors flocked to the greenback on expectations of tighter monetary policy in the Unites States. Stronger economic data increased speculation that the Federal Reserve could hike interest rates in the middle of next year. On the other hand, even though these factors provide greater headwinds for gold, cheap prices and skepticism about the sustainability of the stock market rally continue to attract some buyers.

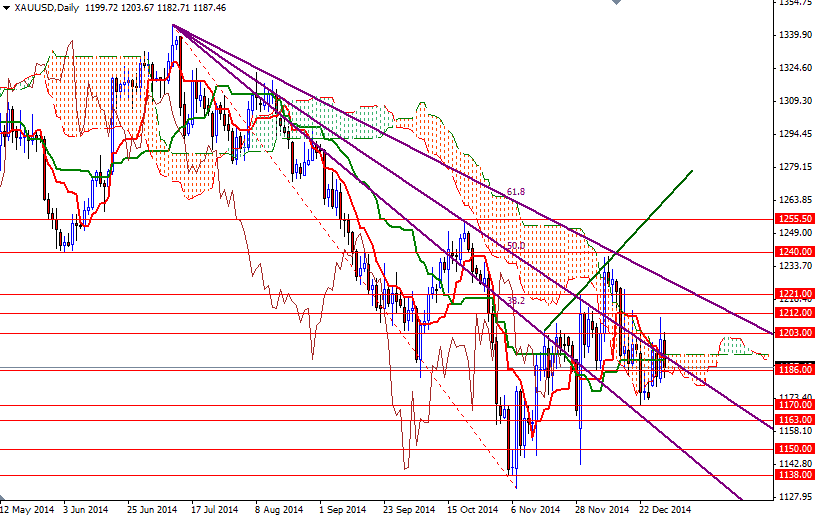

Technically, trading inside the Ichimoku clouds on the daily and 4-hour time frames indicates that the market is still looking for a direction. Speaking strictly based on the charts, I think the XAU/USD pair will need to break either above 1221 or below 1163 in order to gain some momentum. If the bulls can build some steam and get a close above 1203, it is possible that we will see the pair testing the next barrier at 1212. However, if the bears take over, XAU/USD may revisit 1182.40 and 1178/6. Breaking this (1178/6) support may drag prices back to the 1170 level.