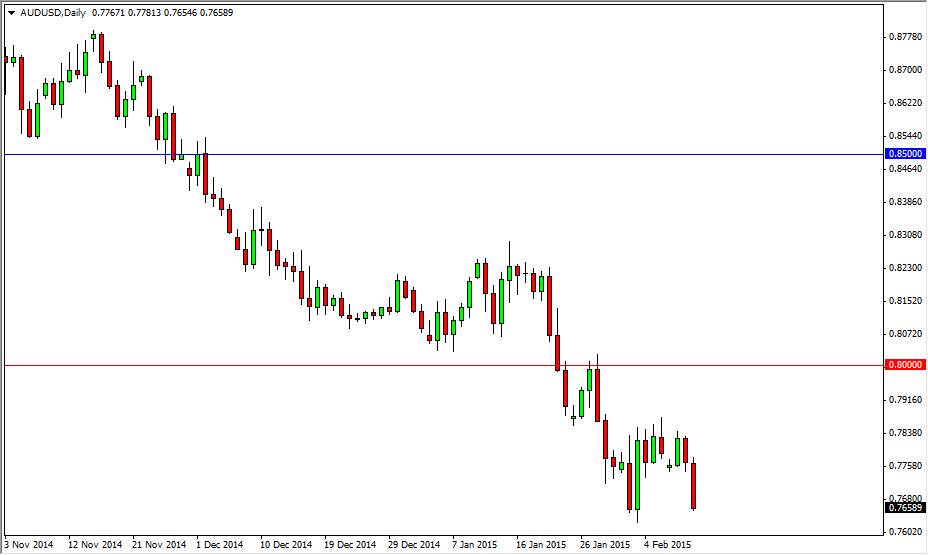

The AUD/USD pair broke down during the session on Wednesday, heading towards the 0.7650 handle to test the recent lows. This was exacerbated by a less than stellar jobs report coming out of Australia as the numbers completely missed the mark. With that, I believe that the Australian dollar will continue to fall and that it’s only a matter of time before we break down to the 0.75 handle. Any rally at this point in time would have to be looked at with suspicion.

I think that the 0.80 level is the absolute “ceiling” in this market, and with that we are most certainly getting ready to see the downtrend extend. If we break down below the 0.7650 handle, I think it’s only matter time before we hit the 0.75 level, and then possibly much lower levels. If that’s the case, I think that there are a couple of different ways you can trade this market, but the Forex markets seem to be more short-term these days than anything else.

Selling rallies as they appear

As far as I can see, I am going to continue selling rallies as they appear. This is a market that should continue the longer-term downtrend as there is so much weight upon the Aussie dollar right now, and then compounding that is the fact that the US dollar is by far the favored currency in the Forex markets. The gold markets haven’t exactly been burning up the trail higher either, so there really is no reason at this point in time to believe that the Australian dollar has any real strength left in it and with that I think sellers will gladly sell this pair based upon “value” in the greenback.

I don’t think the move will necessarily be easy though, because quite frankly there has been such a move large move already that the continuation is going to struggle to find enough sellers to really break this pair down rapidly. Nonetheless though, I think if you look at the short-term charts there will be plenty of opportunity.