AUD/USD Signal Update

There are no outstanding signals.

AUD/USD Analysis

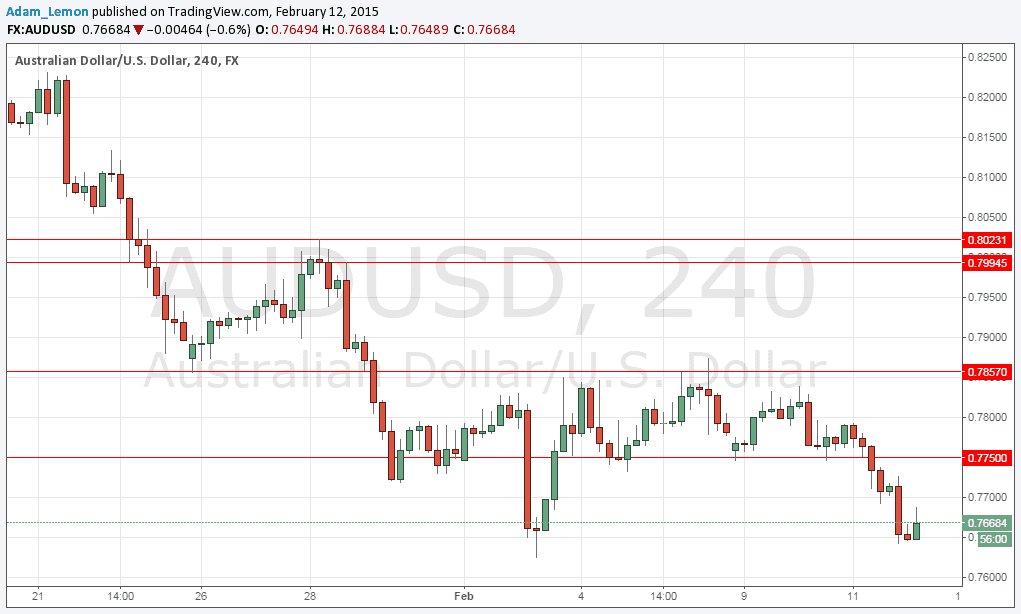

The day before yesterday I forecasted that this pair was ready to drop. Since then, the price has fallen by about 120 pips and the gains are so far being maintained, despite the sudden sharp fall in the JPY which occurred a few minutes ago. The JPY can often move the AUD in the same direction. Despite the Bank of Japan's announcement that it sees no further stimulus and hence will seemingly be giving no further support to the weakening of its own currency, both the JPY and the AUD have begun to weaken in recent minutes, as at the time of writing.

The key level that needed to be broken down yesterday to precipitate the fall was recent support confluent with a key psychological number at 0.7750. After this was broken, during the Australian session there was a release of very poor economic data for the AUD, which drove the price down further and completed the move.

The weakness in the AUD seems to be holding to after possibly taking partial profits it probably would make sense to remain in any open short trade.

We are now close to 0.7625 which will probably act as at least short-term support as it is a strong recent inflection point.

I see 0.7750 as now likely to act as strong resistance if and when it is next visited. There is no major support before the 0.7400 area so there no obvious barriers to a continuing downwards move.