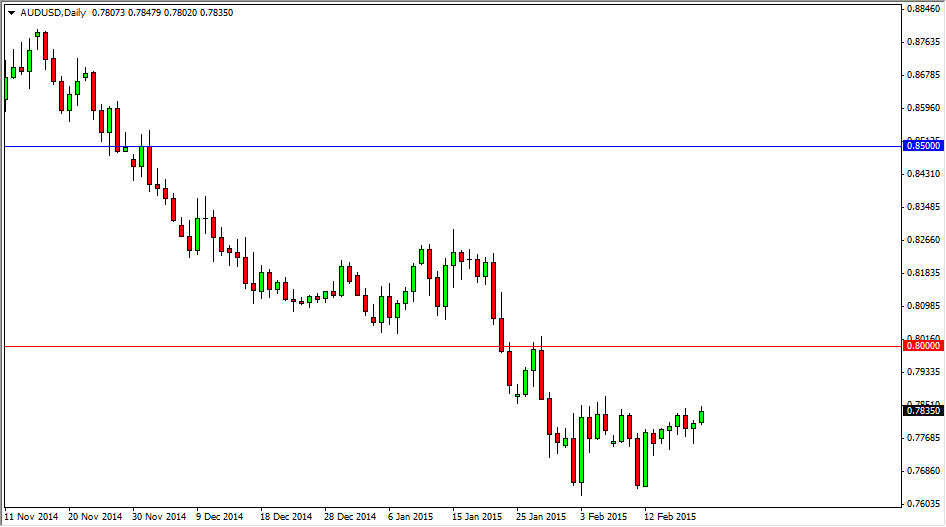

The AUD/USD pair broke higher during the course of the session on Friday, but as you can see there is plenty of selling pressure in general in this pair, as the Australian dollar continues to soften up against the US dollar. I believe that the 0.80 level above is massive resistance, so quite frankly I have no interest whatsoever in buying this market as the Australian dollar has been so beat up over the last several months.

Even if we get above the 0.8080, there is a massive amount of resistance all the way to the 0.83 level in my opinion, so therefore I simply look at any rally as a potential selling opportunity on signs of resistance. That being said, the market should continue to grind lower and I think that sooner or later we head to the 0.76 level, where we saw significant amount of support previously.

Rallies offer opportunity

Looking at this chart, I cannot help but think that short-term traders will continue to punish the Aussie every time it rallies, and quite frankly with the US dollar being so strong in general, it’s almost impossible to go against it. With that, I am simply waiting for some type of resistant candle above in order to start selling yet again. I have traded this market to the downside time and time again, and I don’t see that the attitude is going to change anytime soon.

The 0.80 level was a significant breakout point years ago, and as a result it would not surprise us if it ends up being as massively resistive this time as it was last. Ultimately, we feel that this market will head back down to the 0.75 level, and then possibly even the 0.70 level given enough time as the Australian dollar continues to suffer from not only the soft commodity prices out there, but the fact that Asian growth is in exactly stellar at the moment. With that, I am bearish.