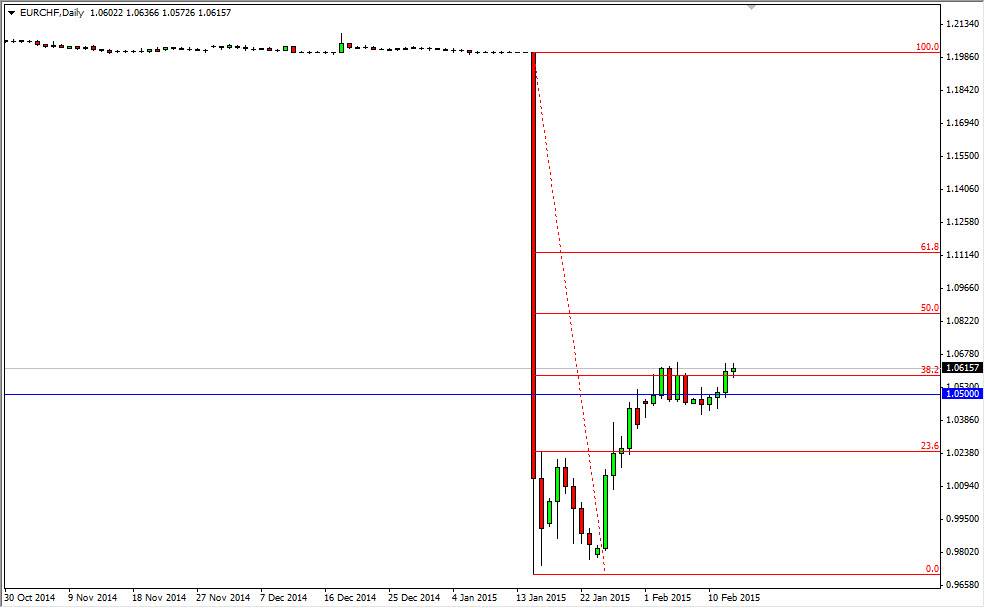

The EUR/CHF pair had a very quiet session on Friday, as we continue to press the top of the recent consolidation which is just above the 1.05 handle. Remember, this is a market that sold off rather viciously after the Swiss National Bank removed the currency peg at the 1.20 handle. With that, the bottom fell out and the market dropped all the way down to the 0.9650 region. That was truly an astronomical move, and somebody somewhere got very wealthy while so many others got wiped out.

The market will remember that move, and as a result I have a Fibonacci retracement drawn on the chart. As you can see, we are essentially bouncing around the 38.2% Fibonacci retracement level right now, so I think it’s likely that this pair pops a little bit higher in order to test the 50% Fibonacci retracement level, or even the 61.8% Fibonacci retracement level. With that being the case, I’m actually going to let the market rise before a search shorting again as it represents a good for value in the Swiss franc.

Sell and sell again

I think ultimately the best way to trade this pair is going to be sell and sell again. It’s probably going to be based upon shorter-term moves, as there is so much “trauma” associated with this particular pair from recent actions. I think only the foolish are buying, and I would suspect that a lot of what we have seen so far has been quite a bit of profit taking. There is no way I would buy this pair, with perhaps the exception of the Swiss bank announcing ahead of time it was going to start another currency peg. Otherwise, I think it just simply makes sense to let the rally have its way, and then eventually start selling again. With an impulsive candle like the one that we got from that tick killer day, it’s going to be a very long time before the market forgets that type of move.