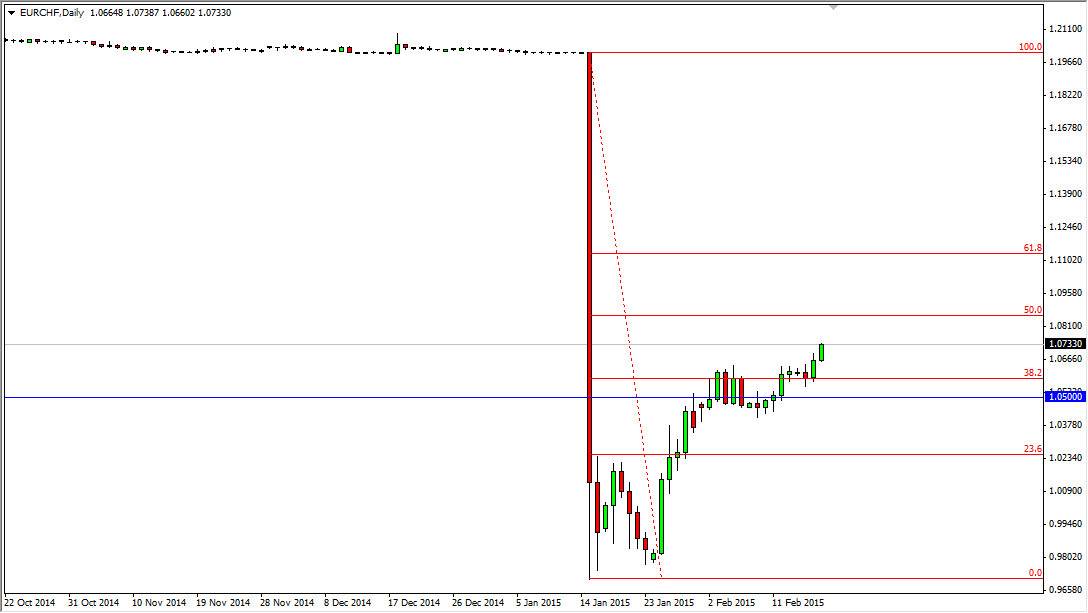

Looking at the EUR/CHF pair, we did break out during the session on Wednesday, and cleared the 1.07 handle. That being said, I am very hesitant to start buying this market even though I fully recognize that we are in fact going to continue going higher. The main reason of course is that this was the “epicenter” of the Swiss National Bank and its surprise, so I have absolutely no interest in going against the massive selloff. Ultimately, the market is one that is going to find sellers. Ultimately, I am simply waiting for some type of negative candle or resistive candle above in order to start selling again as I believe the longer-term downtrend will continue. After all, there are far too many problems with the European Union right now, so obviously the Euro isn’t exactly a currency I want to own.

Simply taking my time

Looking at this chart, I would anticipate that the 1.10 level could be resistance based upon the fact that it is the large, round, psychologically significant number. If not there, I am also looking at the Fibonacci retracement tool that I have plodded on the chart for an area where we could see sellers step back into this marketplace. I believe that the 50% Fibonacci retracement level could be an area where the selling pressure comes back in, and possibly even the 61.8% Fibonacci retracement level.

Ultimately, the market should head back down to the parity level, as the market comes to grips with the idea of the Swiss National Bank no longer fighting to keep the Euro afloat against the Franc. With that, the market looks as if it is one that will ultimately offer a nice selling opportunity if you are patient enough to wait for it. With that, I believe that waiting for the daily close that looks negative is exactly how to go with this market and that buying is absolutely impossible due to the fact that there is certainly more than enough downward pressure overall.