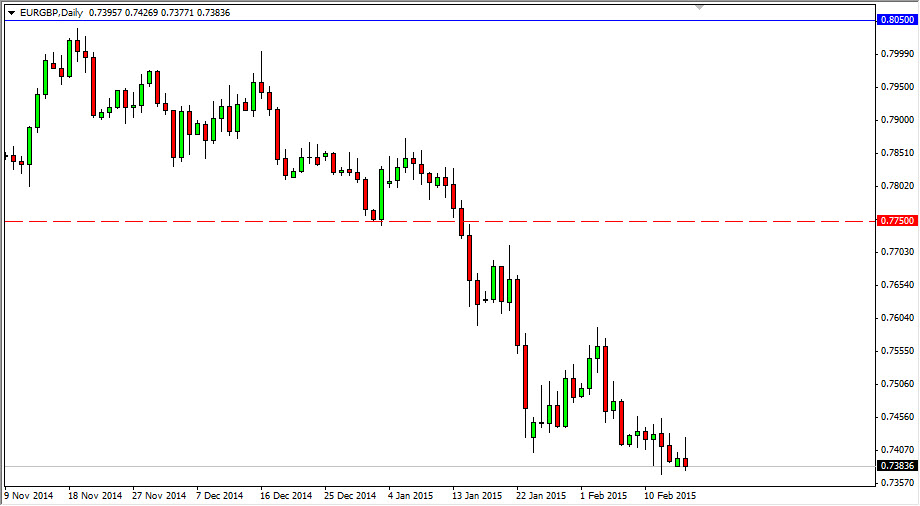

The EUR/GBP pair initially tried to rally during the course of the day on Monday, but as you can see struggled above the 0.74 level to continue its bullish pressure. With that being the case, we ended up forming a shooting star, which of course means that the market should go even lower. A shooting star at the lows of the downtrend of course is always a bad sign, as it shows that even though the market was possibly oversold, it simply could not hang onto gains. With that, a break down to the bottom of the range and below it should send this market going even lower as we should then head down to the 0.70 level.

Any rally at this point time should be a selling opportunity in my opinion, as there is so much downward pressure. In fact, I believe that the market will struggle to even get above the 0.75 level, so I have no interest whatsoever in buying this pair. I believe that rallies just simply offer value in the British pound at this point in time.

Relative value

Keep in mind that you are only trying to figure out relative value in this pair, not whether or not a particular currency is strong. Yes, the British pound has been soft against the US dollar, but it is been much stronger than the Euro and that’s the point. If that’s the case, then this pair should continue to go much lower, perhaps heading down to the 0.70 level over the course of the longer-term. I think that’s the next major support level on the longer-term charts, so it makes sense that we would then head down to that region.

Even if we broke higher than the 0.75 handle, I believe that there is so much bearish pressure at the 0.7750 level should continue to send this market lower, and a resistive candle anywhere between here and there is a reason to start selling as well. I have absolutely no interest in buying at all.