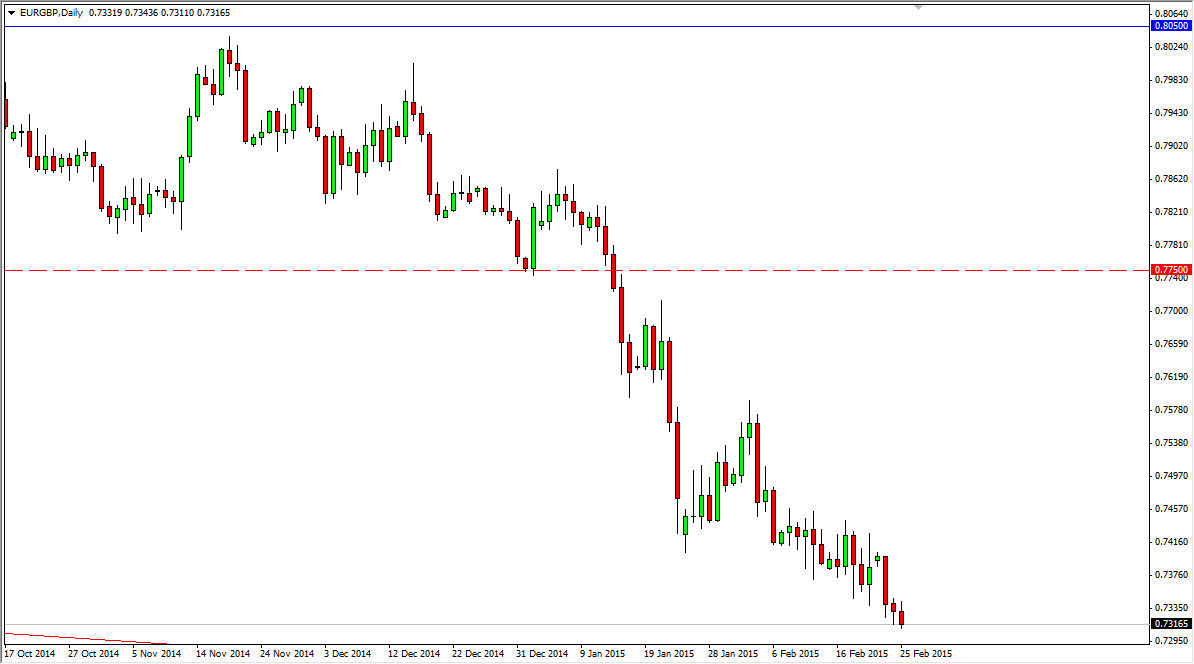

The EUR/GBP pair has made a fresh new low during the Wednesday session, as we continue to see weakness in this market. This of course is representative of the Euro, and the fact that it has so many problems as well as the fact that the British pound has broken out above the 1.55 level against the US dollar. That of course is a bullish sign for the British pound in general, and in an environment where the Euro isn’t going anywhere against the US dollar, it makes sense that the British pound will do better in this particular market as relatively speaking it stronger.

I believe that the 0.71 level below is massively supportive, and it extends all the way down to the 0.70 level. Because of this, I believe that short-term rallies will be selling opportunities as it represents value in the British pound. After all, you have to realize that this is a measurement of relative value between the two currencies.

Downtrend continues

I believe that the downtrend continues overall, as the Euro continues to face quite a bit in the way of fundamental issues. Remember, there is still the drama in Greece, although it appears that the European Union has backed down. Beyond that though, there is deflationary concerns in the European Union, which we do not have in the United Kingdom. With that being the case, this is a market that I believe continues to offer plenty of selling opportunities based upon short-term charts. The reason I say short-term charts is that the pair itself tends to be rather choppy.

I believe that the 0.74 level above is massively resistive, and I know that the 0.75 handle is based upon the large, round, psychological significance of that number. Rallies represent a nice selling opportunity in a downtrend that I think should continue for several weeks. The real fight will be down at the 0.70 level, which is a massive support level on the monthly chart. I do not have a scenario in which I start buying.