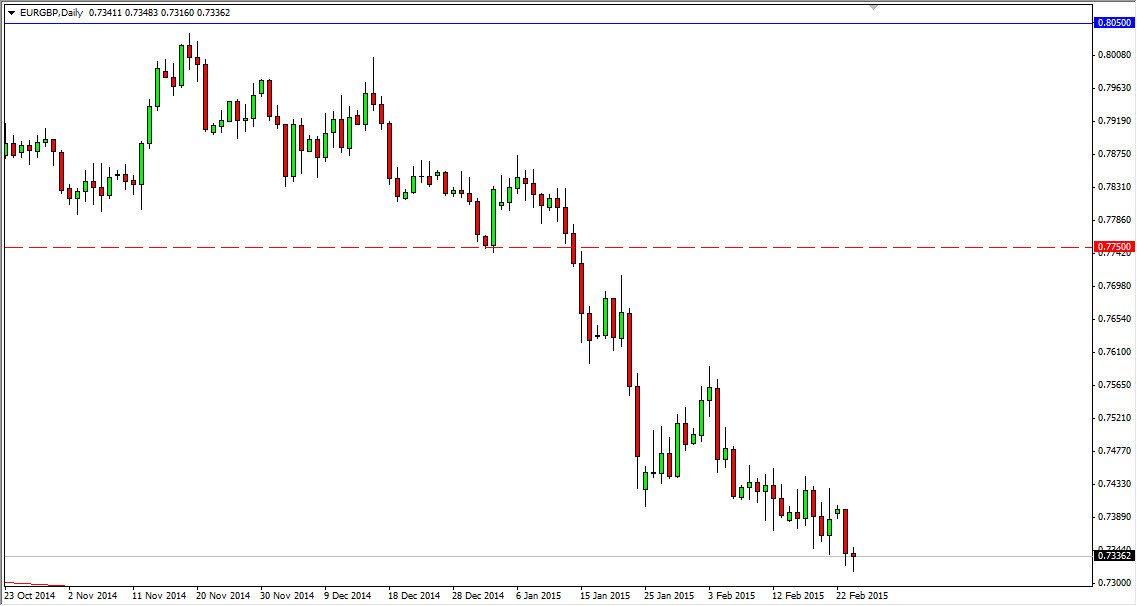

The EUR/GBP pair broke down during the session on Tuesday, finding fresh new lows. However, we bounced enough to form a bit of a hammer, which of course is a fairly decent buying opportunity under normal circumstances. However, I do not feel that this market is one that you can buy. I think that a break of the top of the hammer simply sends this market looking for resistance, probably near the 0.74 handle where I would be more than willing to sell a resistive candle at. On the other hand, if we break down below the bottom of the hammer from the Tuesday session, that just shows more weakness to me and I begin to start selling yet again.

Looking at this market, I think that there is no doubt that we are in a downtrend, and on top of that you have to keep in mind that the Euro is without a doubt in a lot of trouble. The European Union is in danger of going into deflation, which of course could lead to even more liquidity coming out of the European Central Bank.

Looking for selling opportunities going forward

I believe that rallies will continue to offer selling opportunities, and I am looking for short-term traders to step into this market again and again in order to punish the Euro. While I am not necessarily too keen on the British pound, I do recognize that it is at least a reasonably decent currency to own at this point in time, and is starting to strengthen a bit. When compared to the Euro, it’s a pretty solid investment.

I think that we could move down to the 0.71 handle to the downside, and then perhaps the 0.70 level as it is a larger round number on the longer-term charts that would come into play to show significant support. Again, rallies should offer value in the British pound, which of course is exactly how I’m going to approach this pair. Be aware the fact that this pair tends to be very choppy, but at the end of the day with the PIP value being higher than other pairs, it doesn’t need to move as much to make money.