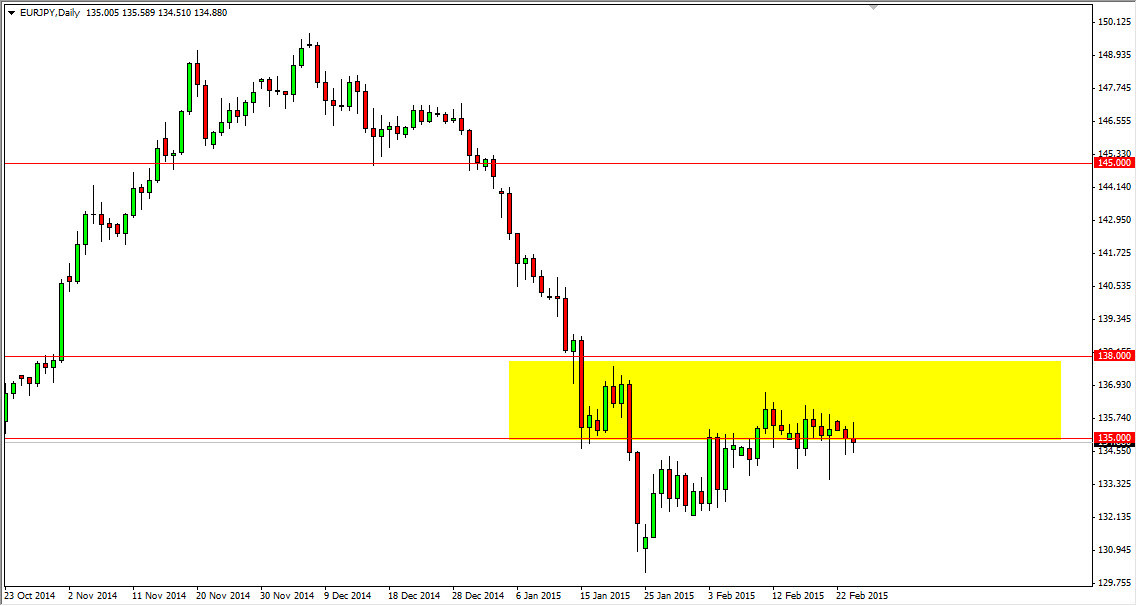

The EUR/JPY pair went back and forth during the course of the session on Tuesday, as the 135 level continues to be a bit of a magnet for price. Ultimately though, the market seems to have quite a bit of resistance above there, extending all the way to the 138 handle. Because of this, the market is going to struggle to go higher and even if we do break higher I am not willing to buy this particular pair. Once we get above the 138 handle though, it changes everything and as a result I would not only be a buyer, but we continue to go long every time it dips. Ultimately though, I do not expect that to happen anytime soon.

I believe that a break down below the Friday hammer is a signal to start selling as it would show the trap door opening. I believe that the downtrend should continue, because the Euro simply has far too many issues at the moment, as the European Central Bank continues offer liquidity measures going forward.

Looking for selling opportunities

I have no interest whatsoever in buying this pair until we get above the aforementioned 138 handle, but am interested in selling any type of break down at this point. I believe that we break below the bottom of the hammer from the Friday session we should then head to the 130 handle, and perhaps even lower than they are given enough momentum and time.

Rallies at this point in time all the way to the 138 level that show resistive candles would be selling opportunities, and with that I am looking for resistive candles above as potential value in the Japanese yen. I’m not a big fan of the Japanese yen in general, but I recognize that the Euro is so soft at this point in time that I have no interest in going long. If we fall from here, I think that the movement could be a bit choppy, but ultimately should be steady over the longer term.