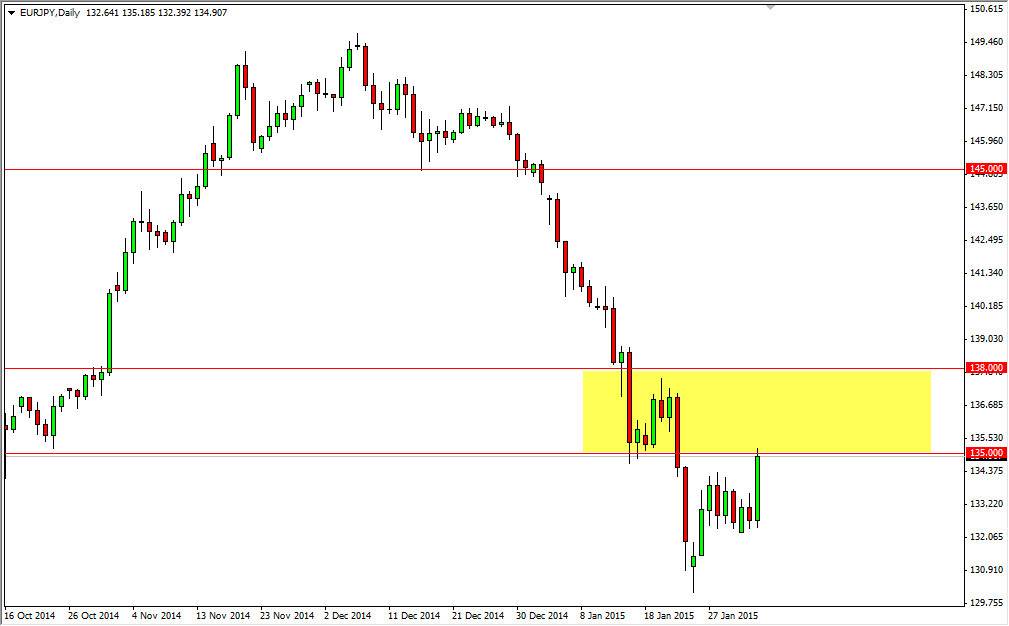

The EUR/JPY pair rose rather rapidly during the session on Tuesday, slamming into the 135 handle. That area is the beginning of significant resistance though, so I am not necessarily interested in buying this pair, and on the contrary, I believe that we will have a nice selling opportunity soon. In fact, I believe that the resistance that runs all the way to the 138 level, and that means that the market should find enough selling pressure between here and there to continue the longer-term downtrend. In fact, it is not until we get above the 138 level on at least a daily close that I would consider buying this pair.

The Euro of course is getting a little bit of a reprieve at the moment in the Forex markets overall, so it of course makes sense that this pair rose during the session on Tuesday also. However, the easy move has already been had, and it now appears that it’s only a matter of time before the sellers will take over again. If that happens, I would not be surprise at all to see this market head back down to the 130 level, which of course is the low that we had tested previously.

Heavy weight above the head of the market

I think that there is a significant amount of weight above the market right now, so it’s only a matter of time before the downtrend continues. The giving wrong, overall I’m not exactly excited about buying the Japanese yen, but it is much more interesting than buying the Euro as far as I can see longer-term. If we did somehow get above the 138 level, at that point in time I would have to switch might bias and start buying this market.

If we did see that, the market would probably then head to the 145 level given enough time. However, I still think that the downward trend will continue for the time being, so at this moment in time I am looking for the resistive candle to start selling.