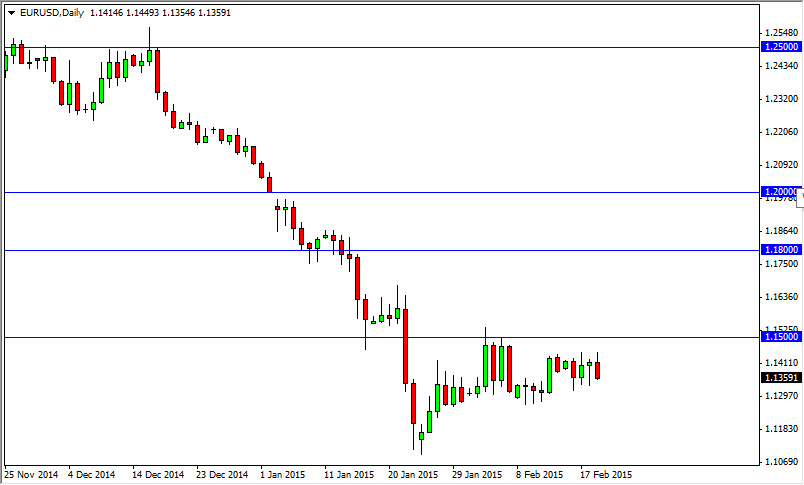

The EUR/USD pair broke higher during the beginning of the session on Thursday, but as you can see fell in order to test the 1.1350 region. In fact, the market has essentially been consolidating between the 1.13 level on the bottom, and the 1.15 level on the top. Because of this, I haven’t been overly excited about trading this pair, but I do recognize that it does overall have a bit of a bearish tone to it. After all, the trend has been very negative and as a result it makes sense to continue to sell rallies from short-term charts.

I believe that the 1.13 level below will be broken, and as a result we should then head to the 1.11 handle. With that, I feel that the market continues offer plenty of selling opportunities again and again, but not necessarily of the longer-term variety as we are so congested in this area.

Taking a break

I feel that this market is essentially taking a break at this point in time, simply because we have sold off so rapidly. It has been rather relentless, and we look at the big picture, the Euro has been sold off by just about everybody who could do so. At this point, I cannot help but wonder who’s left to start selling again? That’s not to say that it won’t happen again, but there certainly needs to be a bit of a breather after that type of move.

Any rally at this point in time will have to struggle with the 1.15 level, and on top of that I believe that the resistance extends all the way to the 1.1650 handle. There is a little bit of room above there, but it only goes to the 1.18 level where we see even more resistance form, extending all the way up to the 1.20 handle, which for me is where the trend changes. Ultimately though, I do believe that the sellers will continue to press the Euro, as the 1.10 level is actually my longer-term target.