EUR/USD Signal Update

There are no outstanding signals.

Today’s EUR/USD Signals

Risk 0.75%

Trades must be made before 5pm London time.

Short Trade 1

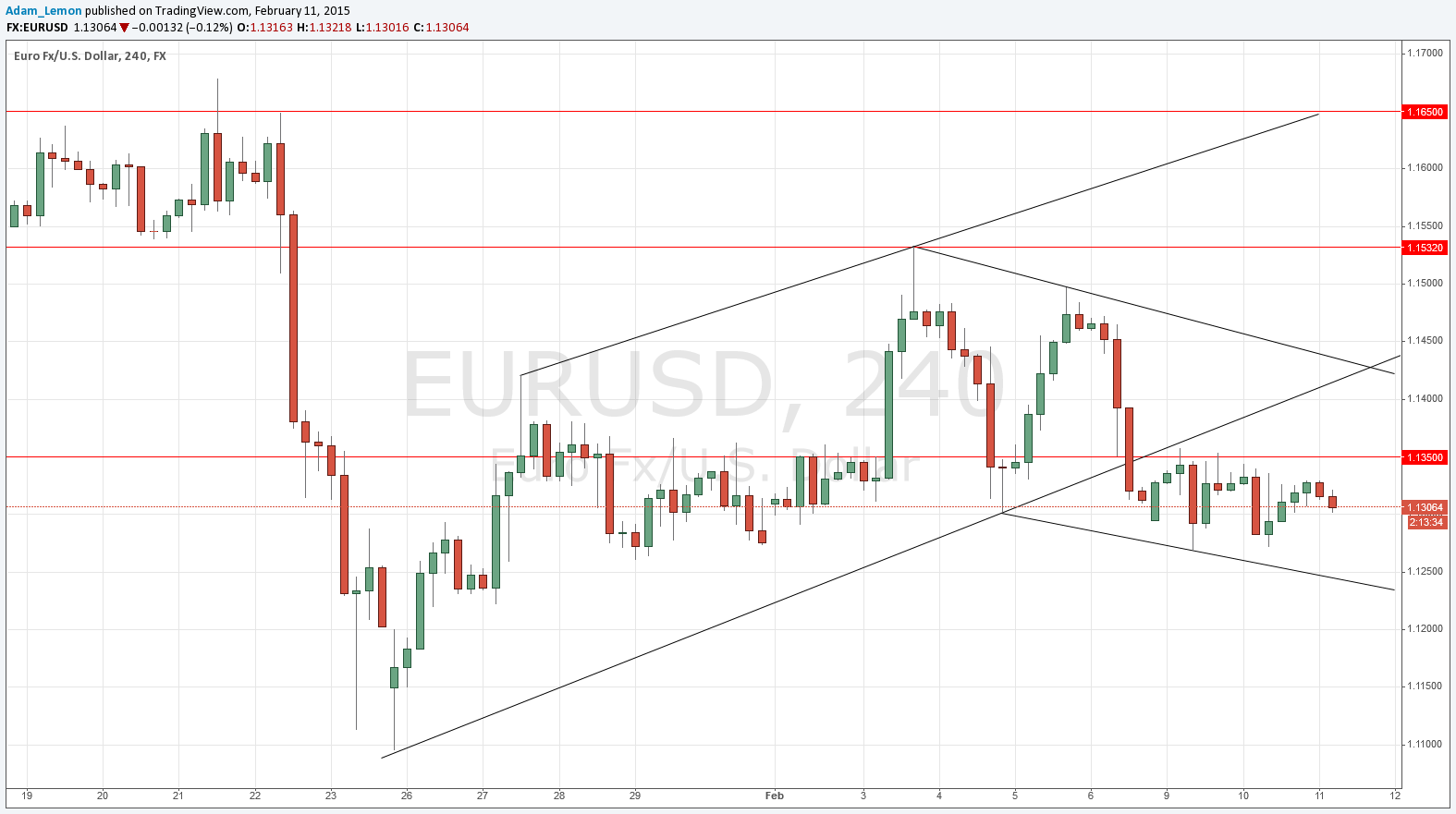

Go short following some bearish price action on the H1 time frame immediately upon the first touch of 1.1350.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 25 pips in profit.

Remove 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to run.

Short Trade 2

Go short following some bearish price action on the H1 time frame immediately upon the first touch of the upper channel trend line above.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 25 pips in profit.

Remove 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to run.

Short Trade 3

Go short following some bearish price action on the H1 time frame immediately upon the first touch of 1.1532.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 25 pips in profit.

Remove 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to run.

EUR/USD Analysis

There is no real change to the technical picture, with yesterday being a narrow range day that bottomed at around 1.1270, just like yesterday.

We are still in a nicely symmetrical bearish channel with probably resistance overhead at 1.1350.

Anything could happen today depending upon news and/or rumours regarding a probably announcement of some kind of outcome of negotiations between EU institutions and the Greek government. If a good deal is made, the price will probably rise quite sharply, but unless it is a really excellent long-term deal the price should fall from that spike. If the spike is held by the trend line or marked resistance levels these could be good opportunities for short trades.

There will be a very important announcement due towards the end of the European business day today, and possibly unpredictable news leaks as well, concerning either the EUR. Therefore it is likely to be a big day for this pair, with a chance of high volatility and wild swings.