EUR/USD Signal Update

Yesterday's signal was not triggered as the price never reached 1.1532.

Today’s EUR/USD Signals

Risk 0.75%

Trades may only be entered between 8am and 5pm London time.

Short Trade 1

Go short following some bearish price action on the H1 time frame immediately upon the first touch of 1.1532.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 25 pips in profit.

Remove 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to run.

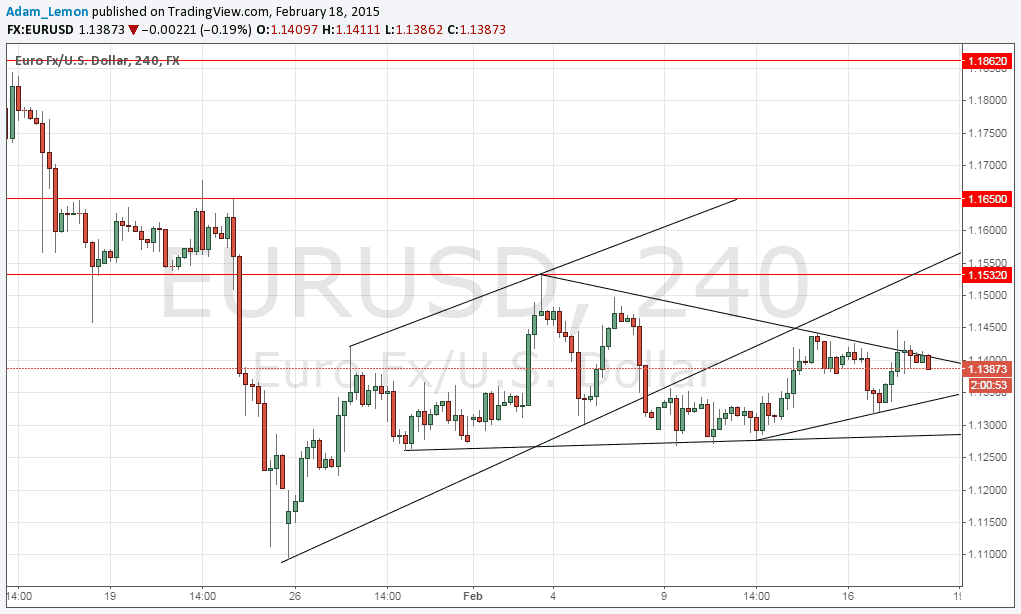

EUR/USD Analysis

Yesterday the price rose quite healthily during the London session on rumours of a bailout extension for Greecen. However the price was not able to really get past the trendline and instead simply consolidated at around 1.1400 after popping up 30 pips or so beyond that at one point. The trend line is still just about holding the price, which is not surprising given the state of indecision that the Euro finds itself.

It may be that there will be no important news about the Euro today and that this pair will take its immediate direction from the USD when the FOMC minutes are released after London closes. If the minutes are bullish for the USD, this pair is a good candidate for a move down towards the 1.1250 area.

On the other hand, the resistance above between 1.1500 and 1.1532 looks like a very attractive place to short if we do manage to break up instead of down.

There are no events scheduled for the EUR today. Regarding the USD, at 1:30pm London time there will be a release of Building Permits and PPI data. After the close at 7pm London time, there will be a release of FOMC Meeting Minutes which should be the most important news event of the day.