EUR/USD Signal Update

Yesterday’s signals expired without being triggered.

Today’s EUR/USD Signals

Risk 0.75%

Trades may only be entered between 8am and 5pm London time only.

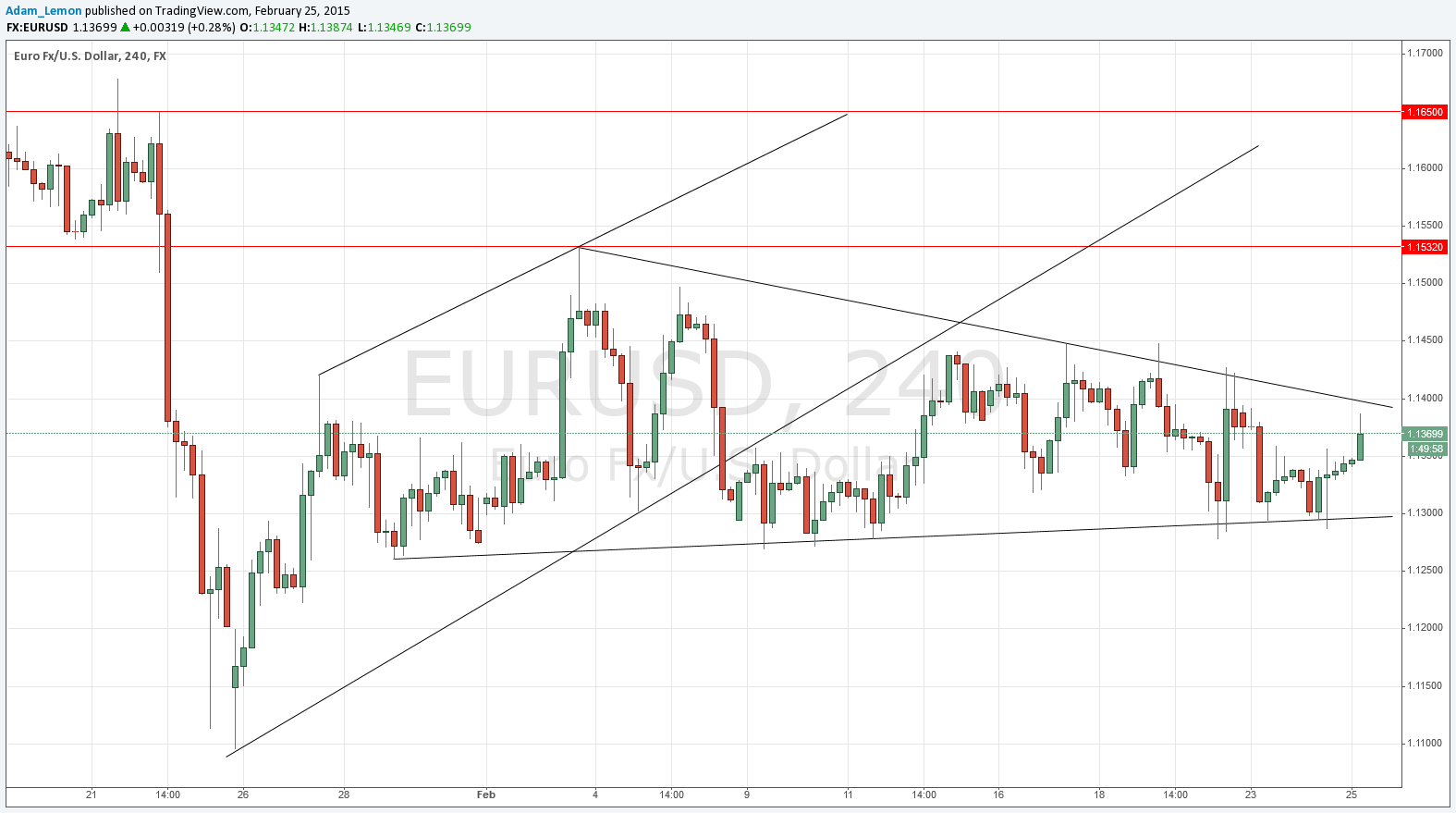

Short Trade 1

Go short following some bearish price action on the H1 time frame immediately upon the first touch of 1.1532.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 25 pips in profit.

Remove 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to run.

Short Trade 2

Go short following a break and failed retest of the lower triangle trend line.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 25 pips in profit.

Remove 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to run.

Long Trade 1

Go long following a break and failed retest of the upper triangle trend line.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 25 pips in profit.

Remove 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to run to 1.1490.

EUR/USD Analysis

We remain stuck within the narrowing triangle for yet another day. A bearish breakout is more widely expected and suggested by the chart, but there is room for an upwards break to reach close to 1.1500 too as there is plenty of blue sky just above the triangle. Therefore a breakout either side can be traded, but a bearish breakout will probably travel further.

There are high impact events concerning both the EUR and the USD today. Regarding the USD, at 3pm London time there will be a release of U.S. New Home Sales data and the Chair of the Federal Reserve will begin her testimony before the House Financial Services Committee. Later at 4:30pm, the President of the ECB will be presenting the ECB’s Annual Report.