EUR/USD Signal Update

Yesterday’s signals was not triggered as although the price did reach 1.1420 during yesterday's London session, there was no bullish price action there.

Today’s EUR/USD Signals

No signals are given today.

EUR/USD Analysis

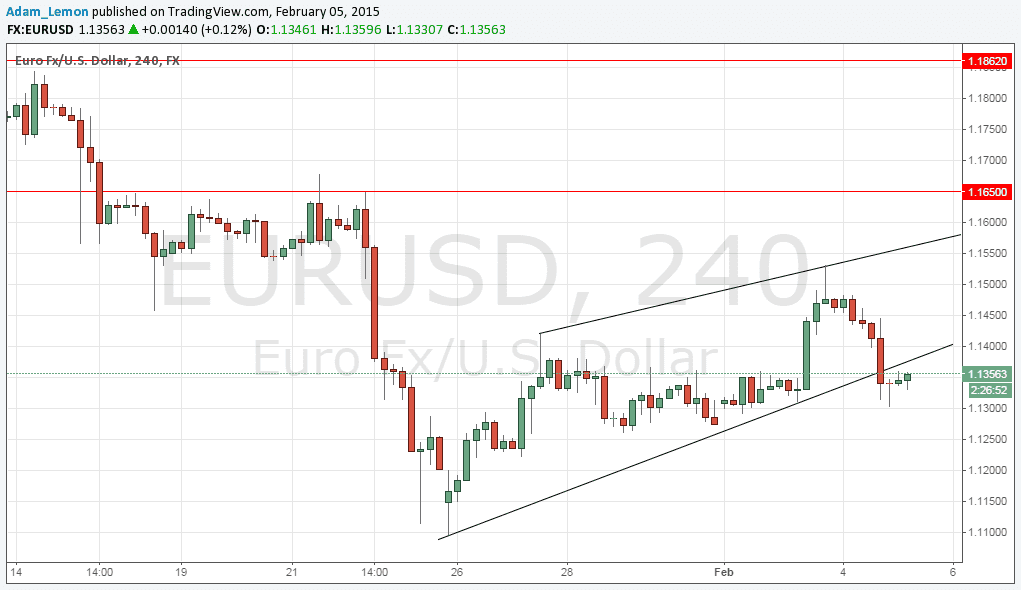

I had thought yesterday that it was most likely that this pair wuld continue to move up, bouncing up from a pull back to 1.1420 or 1.1360 below that. There was support just above 1.1420 but the pair was able to break down fairly rapidly overnight through both those level, and is currently sitting below the broken bullish channel.

Large price movements that may occur today or tomorrow are likely to be driven by high-impact news releases concerning the USD. Technically, we have no obvious support or resistance levels near enough to act as meaningful levels at which to seek price reversals. All we have potentially, which I am not giving as a signal, could be a short off a failed retest of the broken channel's lower trend line, which is above the current price.

We are still well within a long-term bearish trend, and as we reached yesterday price levels from the time of the QE announcement, it would not be surprising if we got a fairly strong fall in line with any positive USD news releases that might come.

There are no high-impact data releases scheduled for later today concerning the EUR. Regarding the USD, at 1:30pm London time there will be releases of U.S. Unemployment Claims and Trade Balance data. This pair is likely to be more active during the New York session than the earlier London session.