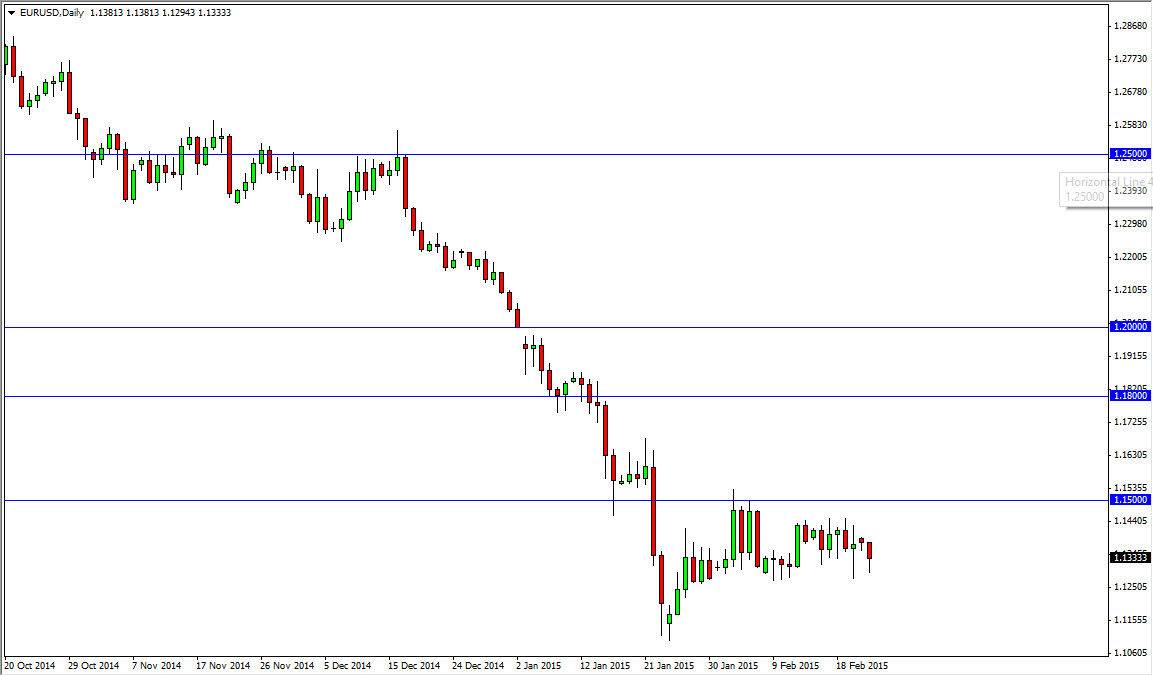

The EUR/USD pair fell during the session on Monday, testing the 1.13 level. We found enough support to bounce and form a hammer though, so it does suggest that the market will continue in the recent consolidative attitude that we’ve had. The bottom of the range is the 1.13 level, and the top of the range is 1.15 handle. With that, it’s very likely that we should continue to go back and forth. I am not a big fan of this pair at the moment, I do recognize that it could bounce a little bit.

I think that overall the trend is still to the downside, and as a result the market will more than likely fall eventually. I feel much more comfortable selling rallies going forward, and with that will look for resistive candles and the like in order to sell this market for short-term moves.

Back and forth

I think that we will continue back and forth in the short-term, as we are simply taking a bit of a rest after a significant fall. Because of this, the market looks ready to head down to the 1.11 handle, but it may take some time for the momentum to build up. The significant fall was rather destructive, and it makes sense that the market would have to relax for a while after such a significant fall. However, consolidation typically means continuation, and there are still plenty of things working against the Euro overall.

I believe that the market should head to the 1.10 level given enough time, but it’s going to take a bit of momentum to break down to that level. Even if we broke higher, I think that the 1.15 level is only beginning of significant resistance all the way to the 1.1650 level. That area is resistive enough that I believe the sellers will step in sooner or later anyway, so this point time I don’t really believe in buying at all. I do recognize that short-term bounces may happen, but quite frankly it’s too dangerous.