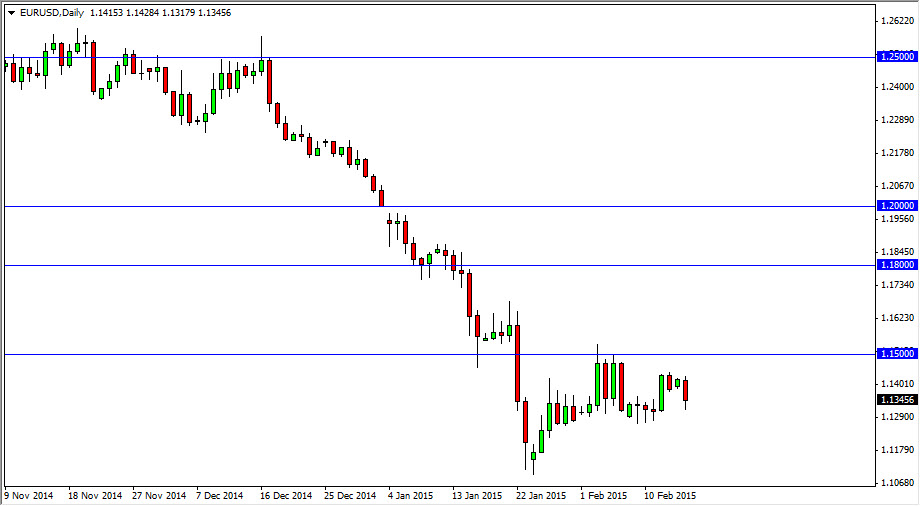

The EUR/USD pair fell during the course of the session on Monday, as the 1.14 level offered a bit too much resistance for the buyers to continue pushing the Euro higher. Ultimately though, this market should continue to go lower given enough time though, as the 1.13 level below is supportive, but not unbreakable. I believe that the 1.15 level above is the absolute ceiling in this market at the moment, and resistive candles in that area will be used to sell the euro again and again.

Even above the 1.15 level there is a significant amount of resistance, as the next cluster extends all the way to the 1.1650 level. The area being broken to the upside would signify a move to the 1.18 handle, which has a cluster of resistance all the way to the 1.20 level. It is not until we break the aforementioned 1.20 level to the upside that I would feel comfortable buying the Euro.

Long-term downtrend should continue

The EUR/USD pair should continue to go lower over the longer term as the European Central Bank has no choice but to keep its monetary policy very loose, and possibly even expand on it going forward. With that being the case, the market should struggle every time it rallies and should be looked at as offering value in the US dollar, which means that it should be one of those markets that can be sold again and again based upon the fact that although we have had a massive amount of selling pressure ready, the truth is that the fundamental analysis certainly does not favor a stronger Euro. Far from it, as the problems in Greece continue to be a weight around the neck of the Euro, considering that the trouble simply will not go away.

With the Federal Reserve looking likely to tighten over the course of the next year or so, it makes perfect sense that the US dollar continues to strengthen during the course of the year, and perhaps try this pair down to parity over the longer term.