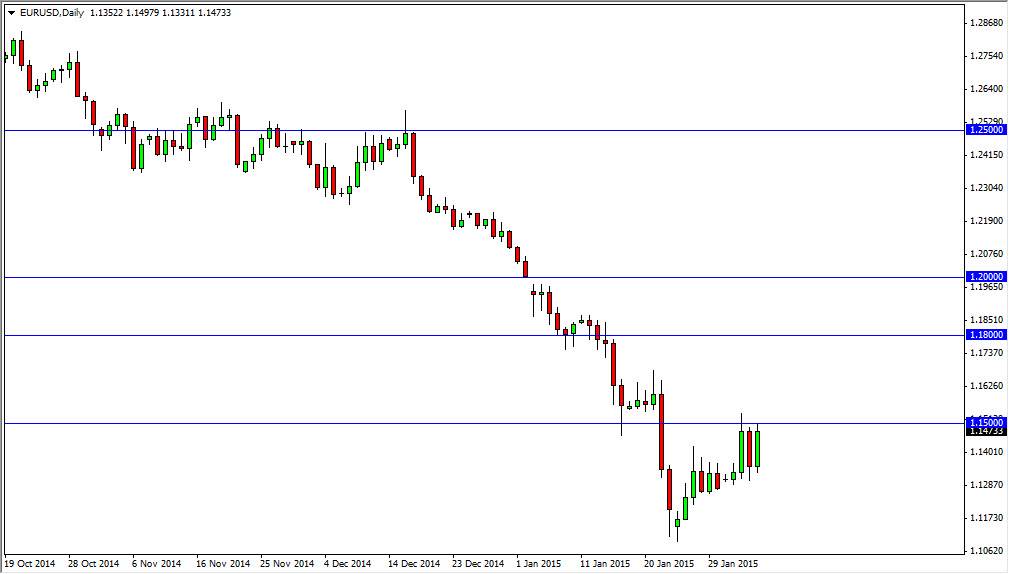

The EUR/USD pair broke higher during the course of the session on Thursday, slamming into the 1.15 level. With that being the case, looks like we are testing this resistance, but today is nonfarm payroll Friday and that of course means a lot of unpredictability in this marketplace. Because of that, a resistive candle or any resistive action between here and the 1.1650 level in my opinion is a nice selling opportunity. This market will continue to struggle above there anyway, so any rally in the Euro should end up representing value in the US dollar. After all, even a poor number out of the job market isn’t going to be enough to change the attitude of the European Central Bank, and it’s needing to loosen monetary policy.

Continuing to sell rallies

Every time this pair rallies, you will have to think of it in terms of relative value. After all, the US dollar goes “on sale” every time this pair rallies, and with that I think it’s only a matter of time before the sellers step been over and over again. It is not until we break well above the 1.20 level that I would consider this a market that I can buy, so really this point time it comes down to whether or not I think it’s in control of the sellers yet again. I think that will be the case continuing forward, unless of course something about the jobs number absolutely terrifies the market.

I still think the 1.10 level continues to be a target, and with that silly matter time before we reach down there. Ultimately, I think this is going to be a lot of short-term trades waiting to happen. I don’t see any way to play this longer-term at the moment, so it’s probably only a matter time before you will get to sell and sell again. However, if we break down below the 1.10 level, I think it’s only a matter of time before we hit the parity level, which is astonishing if you think about it.