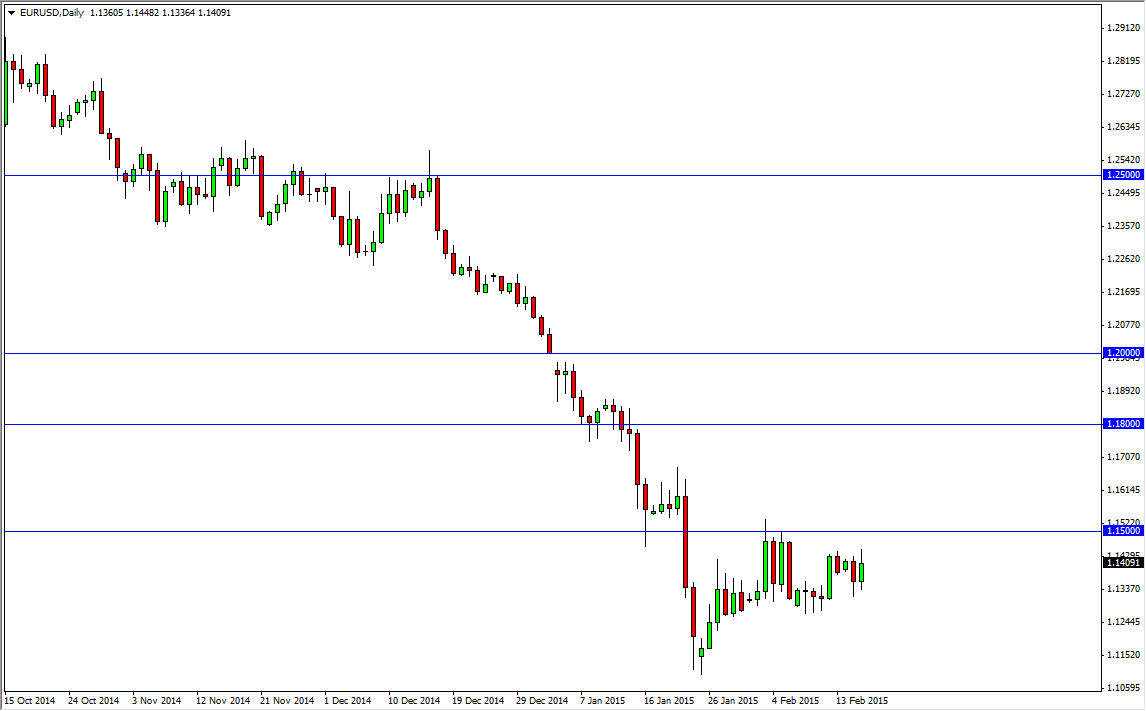

The EUR/USD pair had a slightly positive session on Tuesday, but we remain below the 1.15 handle. This is an area that caused quite a bit of resistance every time we approached it recently, and as a result I think that it will continue to keep a bit of a lid on this market. That helps though, because it has a bit of a backstop feeling to it, and it extends all the way to the 1.1650 level. Because of this, it’s very likely that the sellers will enter this market every time we tried to dig into that massive barrier.

On top of that, the market is obviously in a downtrend in there are plenty of problems with the Euro in general. The US dollar of course is the favored currency around the world and the problems that we keep seeing in the European Union certainly do not help the value of the Euro also.

European Central Bank monetary policy

The European Central Bank looks as if it’s ready to keep its monetary policy fairly loose for some time, and quite frankly it’s likely to continue to put pressure on the Euro overall. After all, the market looks as if every time it rallies there are plenty of people willing to sell. On the other hand, I suspect that the market will more than likely aim for the next major support level, which I see as the 1.10 handle. That is a large, round, psychologically significant number that the markets will more than likely recognize as being important.

Even if we did manage to break above the 1.1650 level, I think that there is even more resistance of the 1.18 handle and extending all the way to the 1.20 region, which if we managed to break above there I feel that the trend would have changed at that point in time. Ultimately, that doesn’t look very likely and I think that we will continue the downtrend over the longer term but it should be a little less full of momentum going forward. In other words, it’s going to take some time.