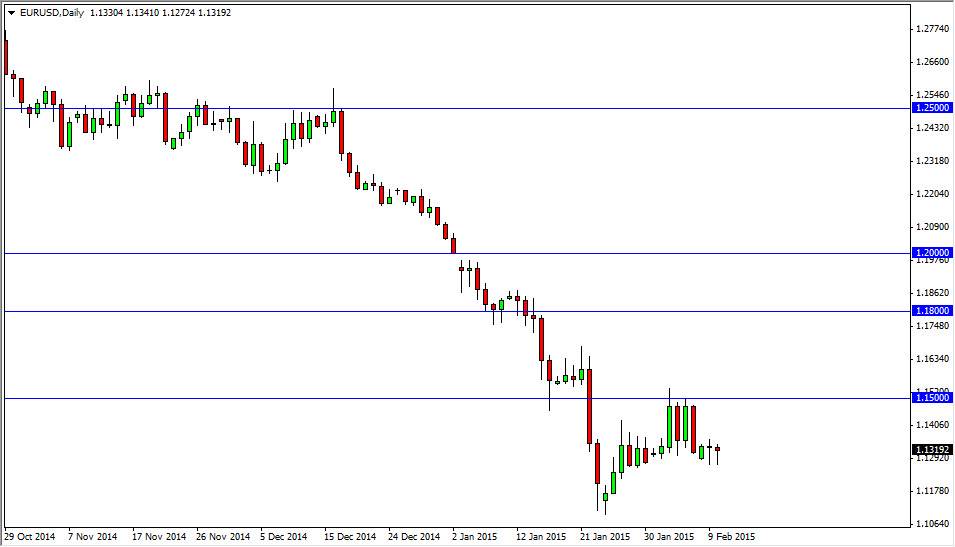

The EUR/USD pair initially fell during the course of the day on Tuesday, testing the 1.13 handle. This is an area that offered a bit of support, and quite frankly doesn’t surprise me. With that, I think that the market will probably try to make its move towards the 1.15 level again, but I’m not interested in buying the Euro as it continues to struggle in general. I think this simply is going to offer a bit of value in the US dollar, allowing us to sell at higher levels, which is ultimately the best play in this particular market as far as I can see.

With that, the 1.15 level begins a massive amount of resistance all the way to the 1.1650 level, and as a result the area should continue to be massively resistive. Ultimately, the market shouldn’t get above there but if it does, there’s still a ton of resistance of the 1.18 level leading all the way to the 1.20 handle. To put it short, I see far too many areas of resistance to be bothered going long of this market.

Longer-term downtrend

As far as I can see, this market is still in a longer-term downtrend, and quite frankly I believe that the European Central Bank will more than likely continue monetary policy loosening, which of course will drive down the value the Euro overall. The jobs number last week was fairly strong, so I think that the US will continue to strengthen overall as well.

Ultimately, I think that the market is going to aim for the 1.10 level below, and if we can get below there we could go much lower than, even possibly as low as the parity level. Short-term rallies continue to offer selling opportunities going forward, and as a result the market should continue to be one that you can trade but probably more or less from the shorter-term perspective than anything else, keeping an eye on the downtrend of the longer-term.