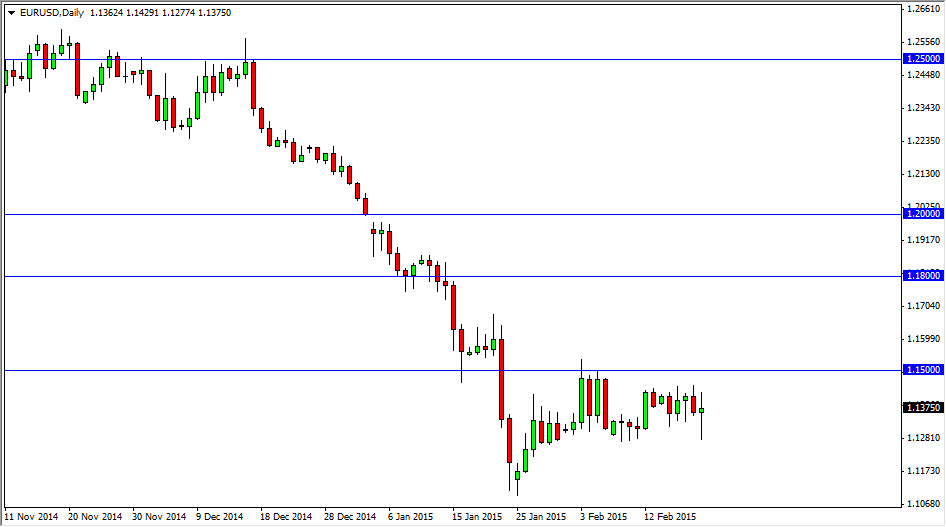

The EUR/USD pair went back and forth during the session on Friday, as we continue to bounce around in a consolidative form. The 1.13 level on the bottom is supportive, and the 1.15 level on the top is resistive. The shape of the candle of course is very long, so having said that it looks like there’s quite a bit of volatility in this marketplace right now. That’s not a big surprise though, as the European Union struggles with possible deflation. On the other hand, the market has fallen significantly over the last several months, so it makes sense that the market needs to take a little bit of a breather after that type of drop.

If we do rally from here, I believe that this market will find plenty of resistance near the 1.15 handle, and therefore I am more than willing to sell resistive candles going forward. I don’t however believe that there is a massive move waiting to happen anytime soon, basically because of the fact that the downtrend has been so strong.

The Federal Reserve

Don’t forget about the Federal Reserve in this equation, as they look like they are more than likely going to keep the monetary policy tight, and possibly even tighten up from there. That being the case, it appears that the market is one that will be traded during short-term charts, and as a result it’s almost impossible to imagine trying to hang on to some type of longer-term move. I do believe that selling is easiest way to go going forward though, as the market should ultimately break down.

Quite frankly, this should be continuation of the downtrend eventually, but in the meantime we may have to play “small ball”, meaning that we will have to continue to sell short-term positions and as a result I will simply wait for each rally to try to pick a little piece of profit out of the marketplace with the understanding that eventually we will break down completely.