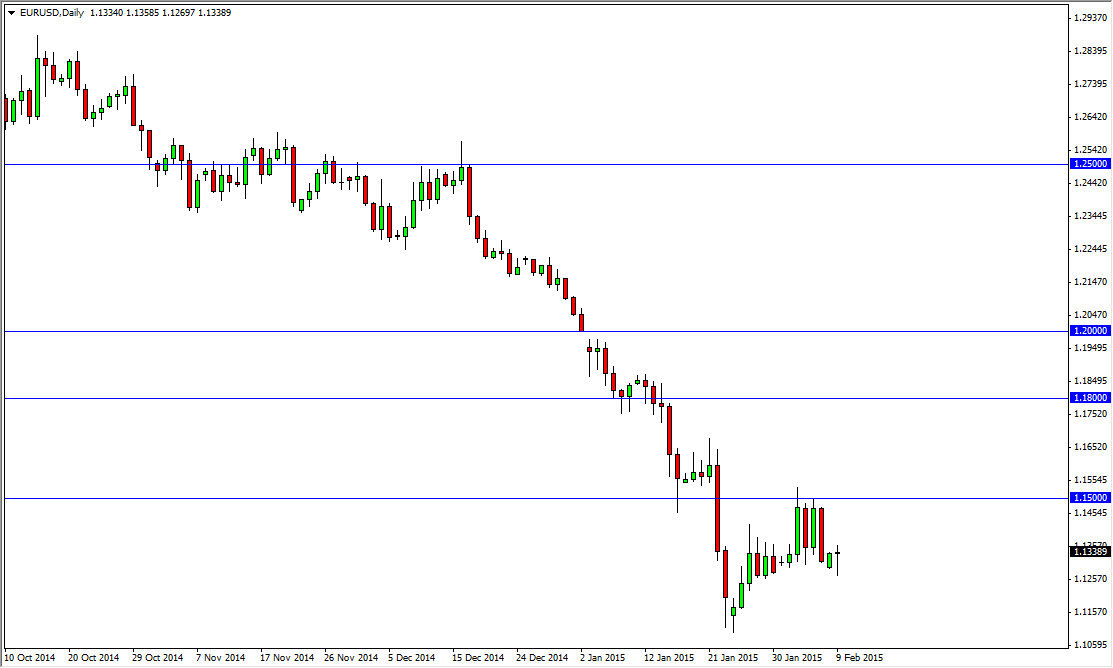

The EUR/USD pair initially fell during the course of the session on Monday, but as you can see bounced off of the 1.13 level. By doing so, it ended up forming a hammer which of course is a very bullish sign. With that being the case, we can break the top of the hammer we would then go to the 1.15 level given enough time, and with that continue the consolidation that we have seen for some time. I suspect that this market will bounce around quite a bit but I still have a very negative outlook on the Euro in general. With that, a resistant candle near the 1.15 level is more than enough to start selling in my opinion as the downtrend should push this pair down to about 1.10 before it’s all said and done.

Waiting for selling opportunities

At this point time, I am waiting for opportunities to sell this pair, and absolutely am ignoring all buying opportunities. Because of this, I am going to be patient but I would like not only the aforementioned resistive candle at the 1.15 level, but a break down below the bottom of the hammer would work just as well. With that, the market would then go much lower. I think that even if we managed to rally from here, there would be a pretty significant amount of resistance to overcome.

The area above the 1.15 level extends all the way to the 1.1650 level as far as resistance is concerned. Because of this, the market should then find a lot of resistance that could turn things back around there as well. Quite frankly, once we get above there it gets resistive again at the 1.18 handle and extends all the way to the 1.20 level. Because of this, there’s just simply far too much in the way of resistance to imagine doing anything but selling anytime soon. With that, I remain bearish and I will not start buying until we get well above the 1.20 handle, something that isn’t going to happen anytime in the near future.