Quantitative Forecast

Academic studies have shown that the most reliable way to determine future price movements from past price movements, is by use of momentum.

In the Forex market, a momentum study is best applied to the four major Forex currency pairs by simply checking whether the weekly close is above or below the weekly close 13 weeks ago.

If the price is higher, the statistical edge is in trading that pair long.

If the price is lower, the statistical edge is in trading that pair short.

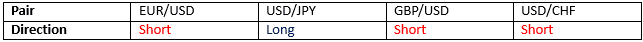

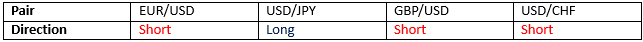

On this basis, the quantitative momentum forecast for the edge during the coming week is as follows:

Technical Forecast

The question as to whether an experienced chart-reading technical analyst can outperform a simple momentum model warrants a live experiment. Looking at the weekly charts for each of the four major pairs, I will try to determine the line of least resistance, and forecast the directional edge using my own technical analysis.

On this basis, my technical analysis forecast for the edge during the coming week is as follows:

Last week saw a further continuation of the pull back against the long-term bullish USD trend. The GBP has continued to strengthen and the EUR is refusing to fall. The CHF continued to weaken but pulled back sharply at the end of the week. Due to the pause in counter-trend momentum, this coming week looks to see some kind of move back in the direction of the long USD trend, and in all four pairs both the technical and quantitative analyses are fully aligned.

Summary

The quantitative and technical forecasts agree that the USD will strengthen against all four paired currencies.

Next week, we will review how these forecasts performed.

Previous Forecasts

These forecasts have been running for 10 weeks.

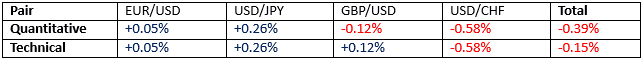

Last week, the technical forecast correctly predicted all of the weekly moves with the exception of USD/CHF. It was more successful than the quantitative forecast, which was also wrong about the GBP/USD:

The running totals of the forecasts after 10 weeks so far are as follows:

Both forecasts have performed negatively to date, due primarily to the very sharp and historically unprecedented counter-trend moves in the CHF over the previous month. However even ignoring that move, both forecasts would still be performing negatively, although the quantitative forecast has been performing a little better.