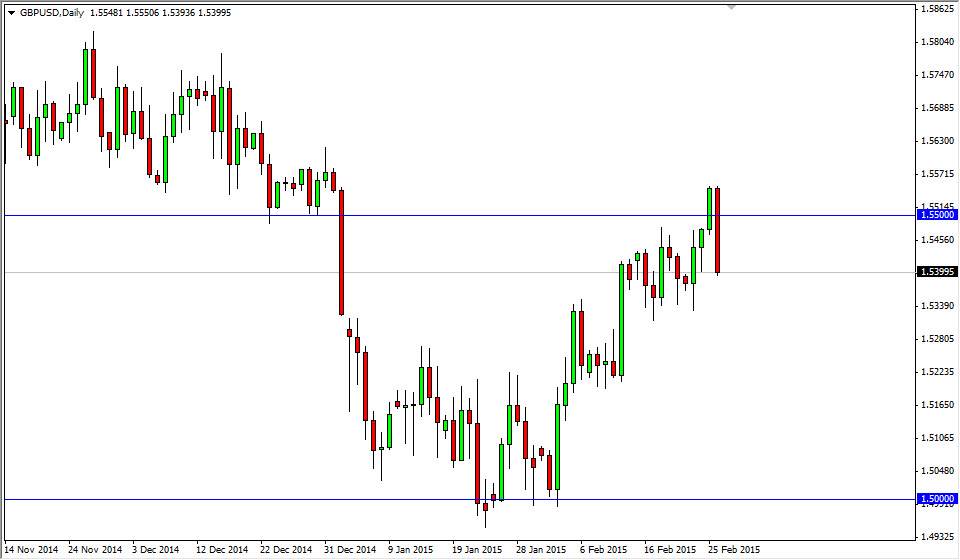

The GBP/USD pair fell rather hard during the session on Thursday, as the 1.55 level continues to offer significant resistance. On top of that, I see that there is a significant amount of resistance all the way to the 1.58 level, so quite frankly I’ve been looking for a reason to start selling yet again. It looks like we have that now, and as a result I continue to be very bearish. In fact, I would love to see some type of short-term rally with a resistive candle closer to the 1.55 level to jump back into this market to the downside. However, if we break down below the bottom of the range for the session on Thursday, I would be a seller there as well as we should then head to the 1.55 handle.

Longer-term downtrend

The US dollar continues to be the strongest currency around the world, so of course you have to pay attention to that when trading this particular pair. The fact that we sold off so drastically during the session on Thursday tells me that we will continue to see bearish pressure in this marketplace, but I recognize of the 1.53 level below of course is a minor support level. It’s not that I don’t think we can get below there, it’s just that it might take a little bit of momentum building in order to do so.

If we break down below the 1.53 level, we feel that this market should then head to the 1.50 level. The 1.50 level below is massively supportive, but it will be a struggle to even get down to that support. I believe that we are going to see overall consolidation on the longer-term, probably between the 1.50 level on the bottom and the 1.55 level on the top. Ultimately though, I think it’s easier to sell this market as the downtrend is most certainly still in effect on the longer-term charts. I have no interest whatsoever in buying at this point.