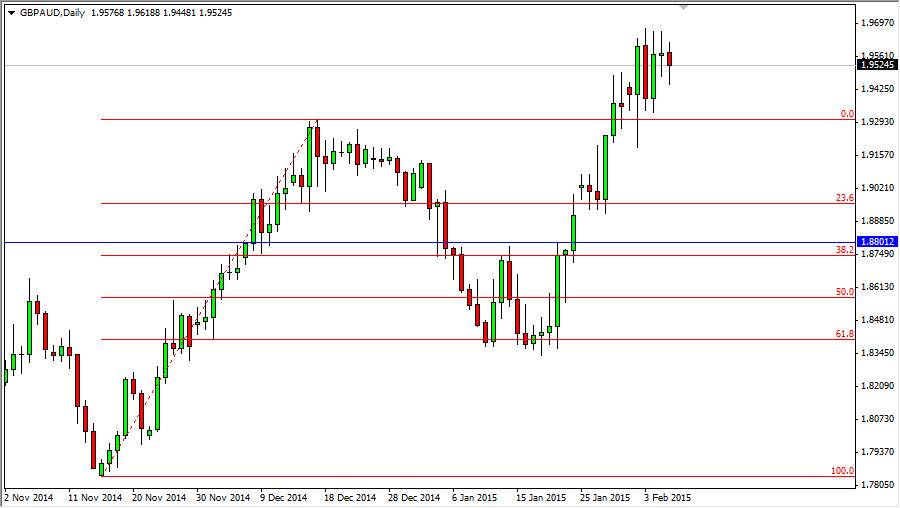

The GBP/AUD pair continues to consolidate near the 1.95 handle. After Friday’s session, it appears that we are simply looking for a reason to break out, because we have recently broken out above the 1.93 level, and now we are looking for more momentum to continue the uptrend. With that being the case, I believe that ultimately this pair goes to the 2.00 handle, as the British pound is starting to look somewhat alive and of course the Australian dollar has been very soft. Commodity markets continue to get beaten down, and that of course isn’t going to do many favors for the Aussie itself.

I recognize of the 2.00 area is going to attract a lot of attention, and should be rather resistive. After all, there isn’t much more of a “round number” than that particular handle. Ultimately, the market should continue to be bullish and I think we could even break above there, but in the meantime I look at pullbacks as potential value in the British pound.

Gold isn’t helping

The matter of the gold markets falling during the Friday session certainly won’t help the Australian dollar. On top of that, even when the gold markets were going higher, the Aussie dollar wasn’t gaining ground. That shows just how soft the Aussie is at the moment, and that there is no real hope of it rebounding anytime soon. Because of this, I am very bearish of the AUD, and will continue to sell it against strong currencies and I believe that the British pound is rapidly becoming one of those.

Expected volatility above keeps me trading this more or less for the short-term because I do not believe that getting beyond the 2.00 level is going to be easy. I think it’s going to happen, but it may take several attempts to get above there, and as a result I will look at this as an opportunity to “buy on the dips” going forward and picking up value in the Pound.