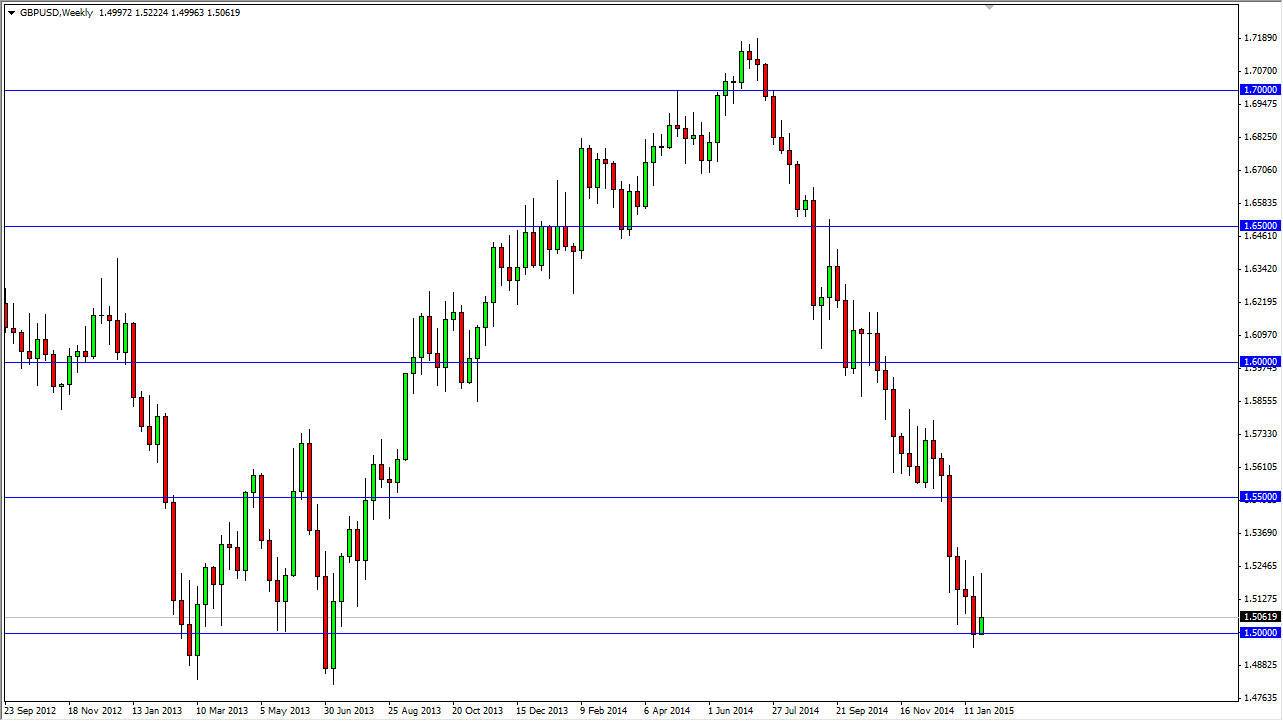

The GBP/USD pair initially fell during the course of January, but did get a little bit of a bounce once we hit the 1.50 level. Nonetheless, the last week of January is trying to form a bit of a shooting star at the bottom of the massive downtrend, and then normally means that we are going lower. However, I do see that there is a significant amount resistance between the 1.50 level and the 1.48 handle, so a move lower in February while possible, might be very choppy. In other words, I would feel much better about a bit of a bounce to the 1.55 handle in order to start selling, but who knows if we will get that?

I believe that rallies will be sold going forward, and that’s essentially how I am playing this pair. It will probably look to shorter-term charts in order to facilitate those trades, as the longer-term charts don’t really have a much room. However, if we get below the 1.48 handle, that would be extraordinarily bearish for the British pound, and I think that the pair would go much lower.

Safety play

Everybody in the world right now is buying the US dollar, and I think that’s going to continue for a while. This is a necessarily a reflection on how bad the British pound is, just simply how strong the US dollar is. Eventually, we will get some type of footing in the British pound, but right now it doesn’t look like we are ready to do so. This could be very choppy month though, so at the end of the day I would feel much more comfortable shorting the Euro than the Pound overall, but I do recognize that if we get below the 1.48 level there could be massive amounts of selling opportunities.

I still believe that the 1.55 level is essentially the ceiling in this market, and would be stunned to see us climb above the cluster of resistance that extends from 1.55 all the way to the 1.57 handle. If we do get above there somehow, I would consider the trend broken and would start buying.