GBP/USD Signals Update

Yesterday’s signals expired without being triggered as although the price did reach 1.5350, there was no bullish price action there.

Today’s GBP/USD Signals

Risk 0.75% per trade.

Trades must be made before 5pm London time today.

Long Trade 1

Go long after bullish price action on the H1 time frame immediately following the next touch of 1.5250.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 30 pips in profit.

Take off 50% of the position as profit when the trade is 30 pips in profit and leave the remainder of the position to ride.

Short Trade 1

Go short after bearish price action on the H1 time frame immediately following the next touch of 1.5482.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 30 pips in profit.

Take off 50% of the position as profit when the trade is 30 pips in profit and leave the remainder of the position to ride.

GBP/USD Analysis

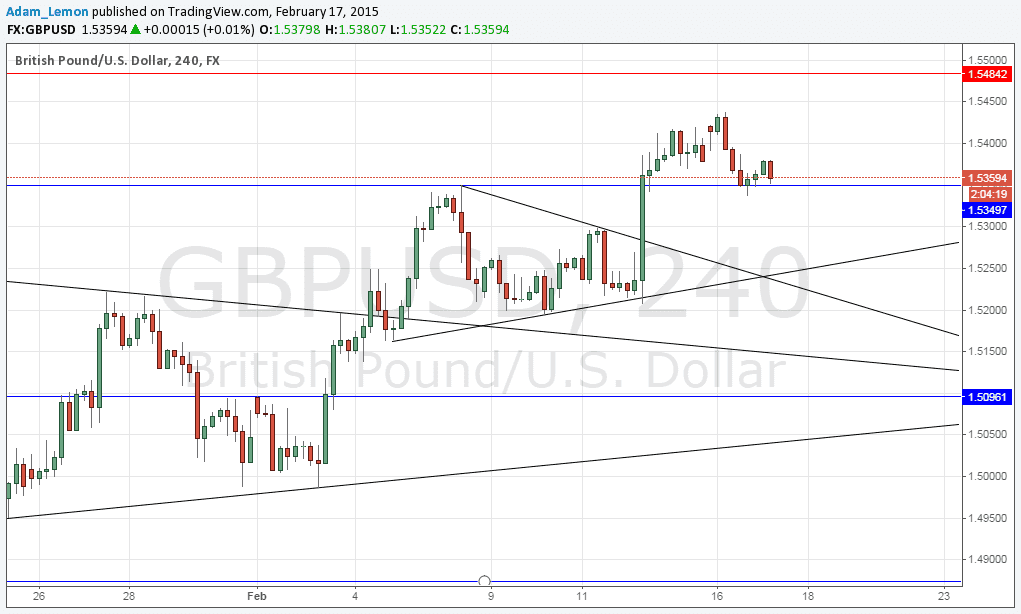

As anticipated yesterday was a fairly quiet day. The expected flipping resistance to support at 1.5350 was not reached until very late in the London session and did not strictly hold as there was an hourly close below that level. However the zone has proved to be supportive since then, with the price moving up from there, so technically this pair still looks bullish.

I would not look to 1.5350 again but prefer a further drop to 1.5250 confluent with the bullish trend line shown in the chart below.

A long trade is prefereable to a short today but if there is a fast move up to expected resistance at 1.5482, bearish price action should see a subsequent fall from there.

At 9:30am London time there will be a release of U.K. CPI data which is likely to have an impact upon the GBP. There are no events scheduled for the USD today but as yesterday was a public holiday in the USA it is quite likely there will be an appetite in the US market, leading to a day with some healthy volatility for this pair.