GBP/USD Signals Update

Yesterday’s signals were not triggered and expired.

Today’s GBP/USD Signals

Risk 0.75% per trade.

Trades may only be entered between 5pm London time today.

Long Trade 1

Long entry after bullish price action on the H1 time frame immediately following the next touch of 1.5250.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 30 pips in profit.

Remove 50% of the position as profit when the trade is 30 pips in profit and leave the remainder of the position to run.

Short Trade 1

short entry after bearish price action on the H1 time frame immediately following the next touch of 1.5482.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 30 pips in profit.

Remove 50% of the position as profit when the trade is 30 pips in profit and leave the remainder of the position to run.

GBP/USD Analysis

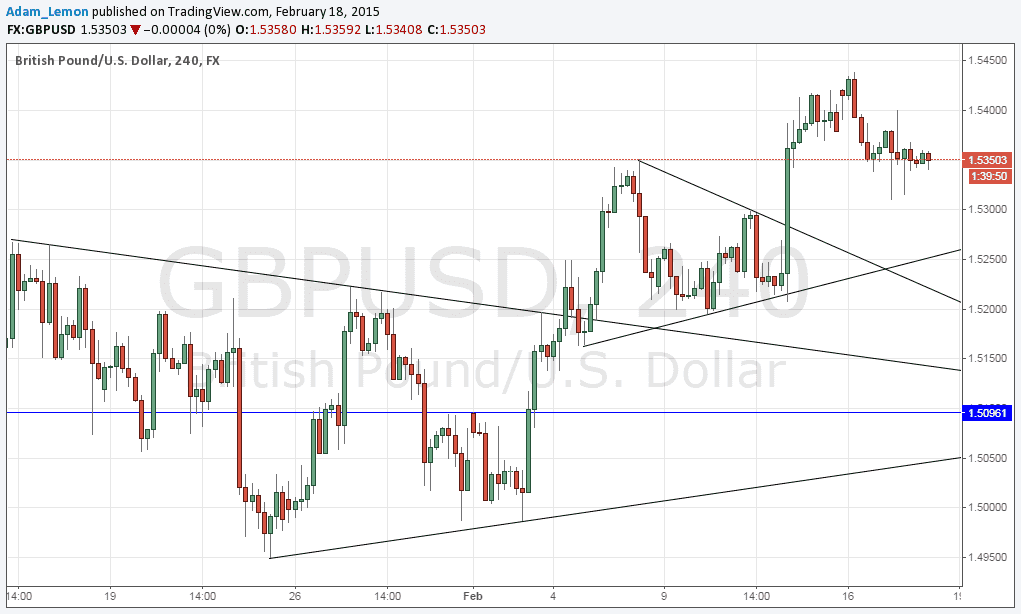

The GBP made a move up yesterday after some positive UK data was released but quickly fell back again to below the previus expected support at 1.5350. Overall the pair still looks bearish and a dip down to 1.5250 is likely to see this pair pick up enough bullish momentum to have another attempt at 1.5400.

At 9:30am London time there will be a release of several items of U.K. Data: Average Earnings, Claimant Count Change, and MPC Rate Votes details. Regarding the USD, at 1:30pm there will be a release of Building Permits and PPI data. After the close at 7pm, there will be a release of FOMC Meeting Minutes which should be the most important news event of the day. Therefore today is likely to be a volatile day for this pair.