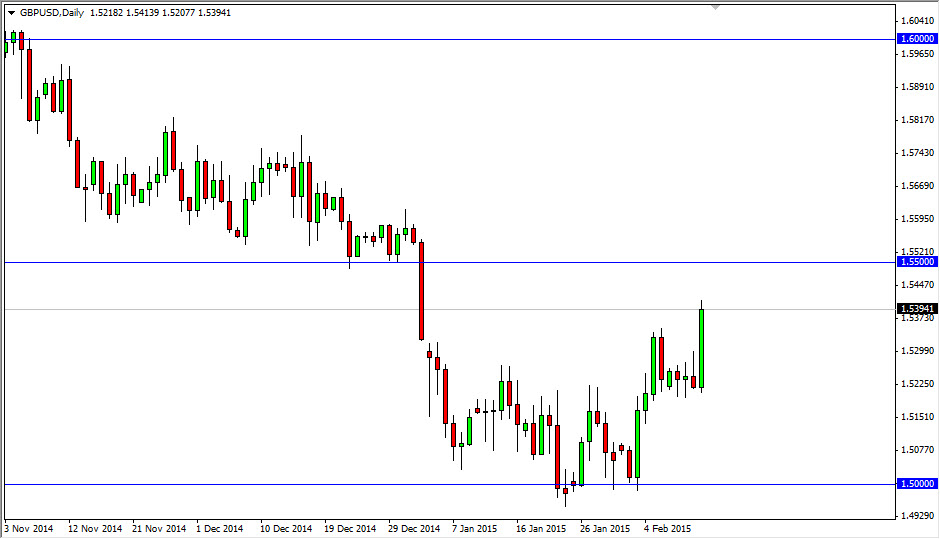

The GBP/USD pair broke higher during the course of the session on Thursday, breaking the top of the shooting star from the Wednesday session. That being the case, looks very likely that this pair will continue to go higher based upon this bullish move. Ultimately, the market should then head to the 1.55 level, which should be massively resistive based upon the fact that it was previously supportive. In fact, I am actually ignoring the fact that the British pound looks so bullish all of a sudden and looking to sell closer to that 1.55 handle which I think will bring in the longer term traders, hence larger amounts of money.

Given that we broke out during the session, I think there are too many issues in the global markets to think that the US dollar will get sold off for very long. With this, I am simply looking at selling this market at the aforementioned 1.55 level as I think it should be a perfect entry point. So having said that, even though there are short-term bullish traders out there, I think it’s probably easier just to wait for that move.

Massive resistance above

I believe that there is a massive amount of resistance above, especially once you get to the 1.55 handle. There are a possible three handle’s worth of resistance above there, meaning that I don’t think it is actually safe to buy this pair until you get above the 1.58 handle, something that does not look likely to happen anytime soon. Anywhere between here and there that we see resistance, I am more than willing to start selling as this market should continue to find sellers overall.

However, the 1.50 level below is going to be massively supportive as well so I don’t think we will break down below there in the near term either. I think this is going to continue to be a bearish market overall, but going to be more volatile than anything else.