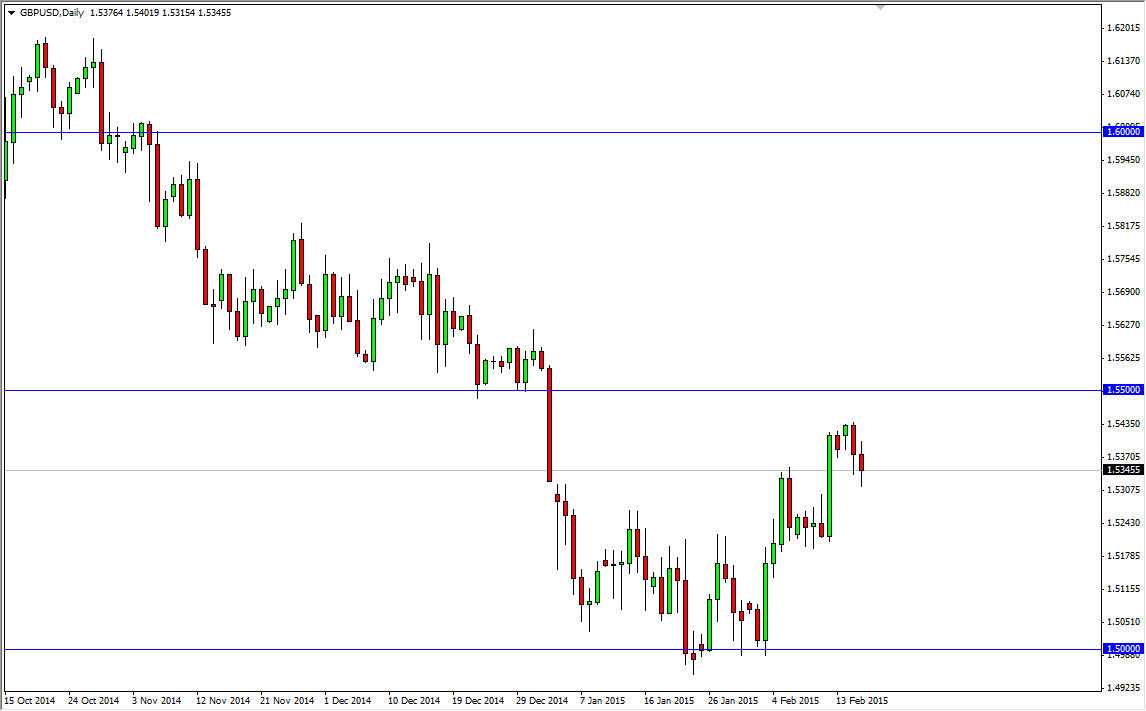

The GBP/USD pair fell during the course of the session on Tuesday, as we tested the 1.53 level for support. It did in fact show that support, and as we are closing the session it looks as if we will form something along the lines of a hammer. Because of this, I believe that this market will bounce from here and head towards the 1.55 handle. On top of that, we have broken above a potential trend line, so that suggests to me that there could be a potential trend change. However, I would submit that the 1.55 level is massively resistive and it extends all the way to the 1.58 level. Because of that, even if we did in fact break higher than the 1.55 level, it’s very likely that we will get some type of pullback.

Recent upward momentum

We have had recent upward momentum in the British pound, and with today being the MPC minutes release, I believe that it’s very likely that we could get a bit of volatility in this together pair. I also think that the US dollar is a bit overextended at this point time, so to see it soften up a little bit wouldn’t exactly be a real stretch. Ultimately though, I believe that the downward pressure will reenter the marketplace and push this pair lower, especially near the 1.55 level. So simply this is a “two speeds” market at the moment, as I believe that short-term traders will look to the upside, while longer-term traders continue to look at the US dollar as the currency to own.

Because of this, I fully anticipate quite a bit of volatility, and it would not surprise me at all if we just simply bounced around in this general vicinity. However, Forex markets tend to be a lot like Ping-Pong, in the sense that they go from one point to another and back and forth. I think that’s exactly what we are about to see, and at this point in time it would make sense if we test the 1.55 handle next.