Gold prices ended Tuesday's session down 1.71%, or $21.07, to settle at $1209.67 an ounce as market players cashed in recent gains after the market failed to breach the $1232/3 key resistance area once again. Also helping to fuel profit taking in the precious yellow metal was a general risk-on attitude in the markets. Stock markets are going up and that is soaring the demand for disaster insurance. In the latest economic data, the New York Fed's manufacturing index came in at 7.8, down from the previous month's 10 but it didn't have a long lasting impact on the dollar.

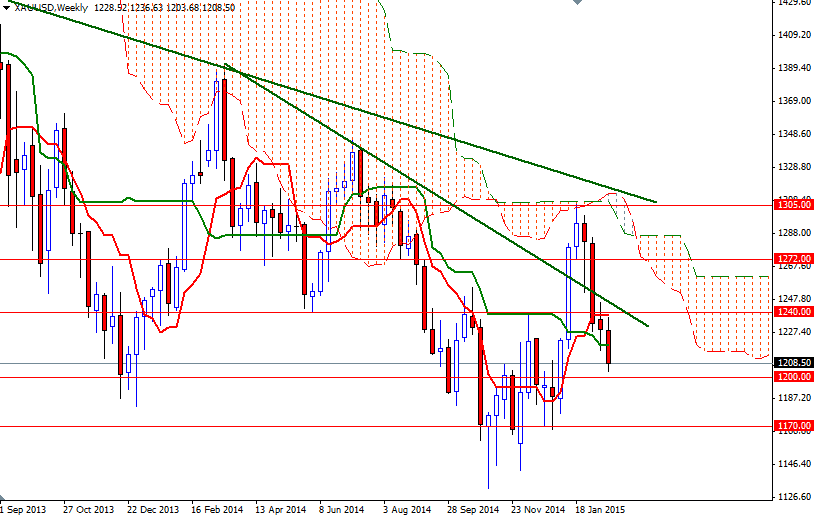

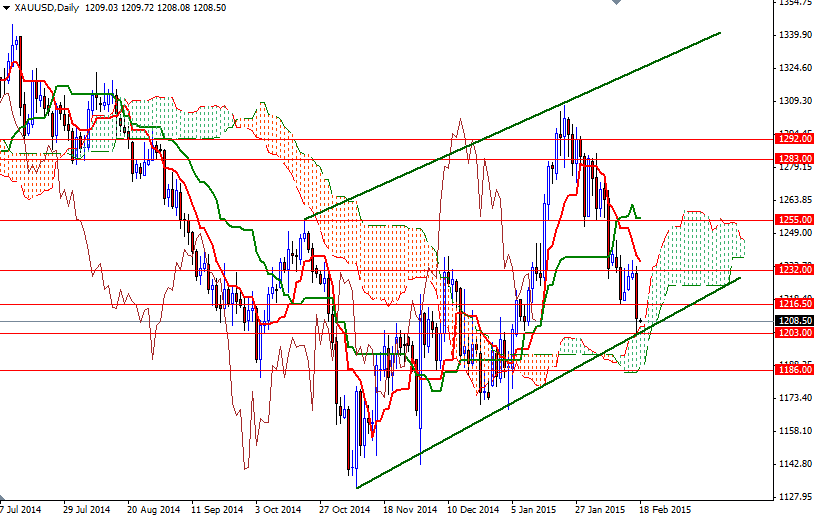

The XAU/USD pair extended its losses after shattering the support at the $1216.50 level and traded as low as $1203.68, a level not seen since January 6. As I have pointed out in my previous analysis, the area between the 1203 and 1186 levels will play a critical role in the near term. Since the ascending trend line and the daily Ichimoku cloud coincide in this region, it is possible to see some support.

The minutes from the last FOMC meeting is scheduled for release today so it could be either the support prices need to climb above the 1216.50 level or the catalyst to test the support at 1186. A break below the 1186 level might put us back on track with such a scenario eying subsequent targets at 1170/66 and 1159. Beyond 1216.50, resistance can be found at 1223 and 1232/3. Only a move beyond the Ichimoku cloud on the 4-hour time frame would imply that the short-term technical outlook is shifting to the upside.