Gold prices declined $6.46 an ounce on Thursday as demand for the greenback increased after the weekly unemployment claims data came in better than expected. The Labor Department said initial claims for state unemployment benefits fell to 283K from 304K. The XAU/USD pair initially tried to rally to break through the 1223 level but encountered heavy resistance and reversed, closing near the low of the day. Despite the uncertainty in Europe, markets hope that Greece and its euro zone partners will eventually reach a deal, but the time is ticking.

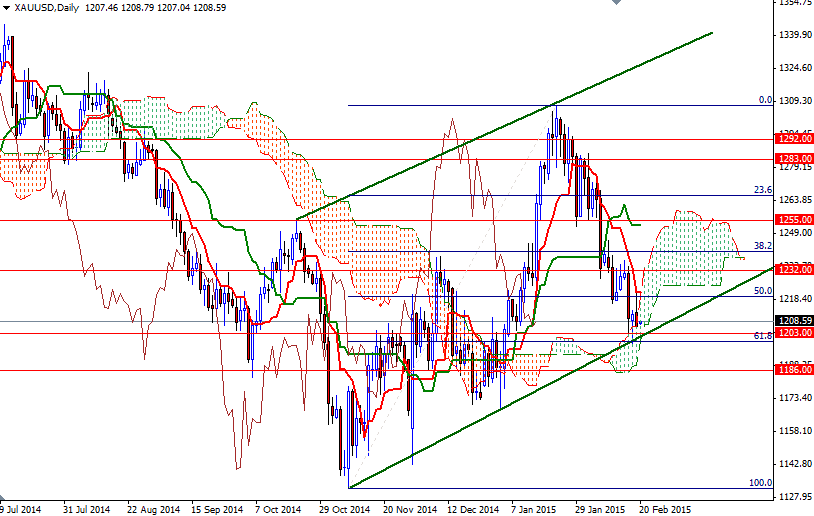

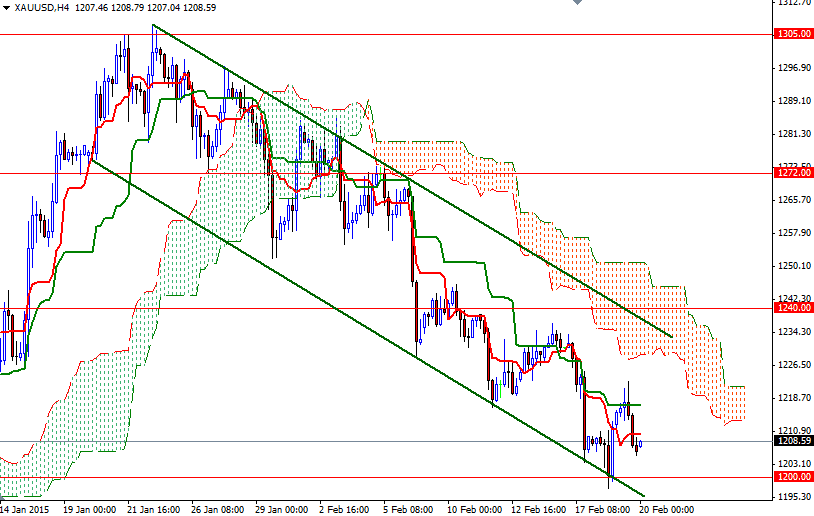

The technical picture remains weak while the Tenkan-sen (nine-period moving average, red line) is moving below the Kijun-sen (twenty six-day moving average, green line) on both the daily and 4-hour time frames. On the other hand, the price action of the last two days (yesterday's shooting star and Wednesday's hammer) suggest that we are going to be range bound. Trading within the boundaries of the Ichimoku cloud also supports this theory.

To the downside, initial support is at 1203/0, followed by the weekly low of 1197.50. The bears have to drag the market below the 1197.50 level so that they can gain enough momentum to test the support at the 1186 level. Closing below 1186 would suggest that the next stop might be the 1170/66 area. However, if the XAU/USD pair find support and the ascending trend line that the market has been respecting for the last few months remains intact, it is possible to see prices revisiting the 1217.07 and 1223 levels. Beyond 1223, the next challenge will be waiting the bulls at 1232.