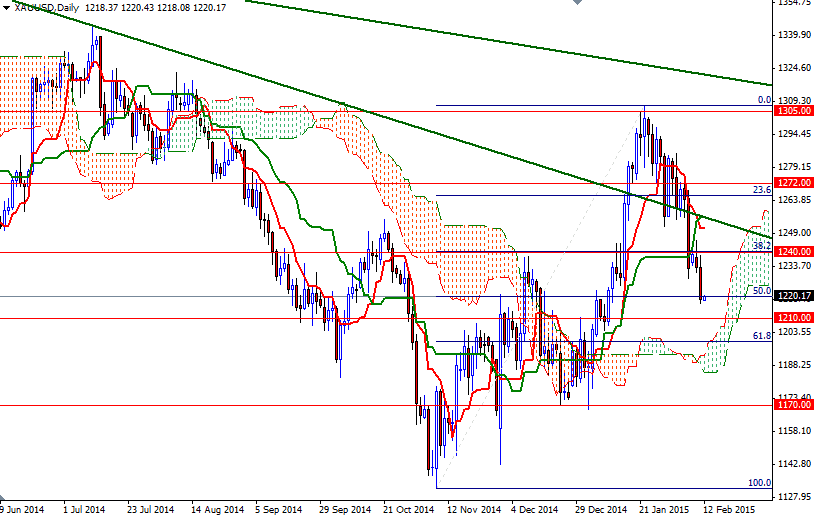

Gold prices settled lower yesterday, extending losses from the previous session, as strength in the dollar overshadowed worries over Greece's debt negotiations. The market initially tried to get back above the 1240 level (the 38.2 retracement of the bullish run from 1131.96 to 1307.47) but prices remained under selling pressure and continued falling. As a result, we reached the 1221/18 area as expected.

Recently the subdued outlook for global economic growth and persistent talks about interest rate hikes in the U.S. for the second half have been weighing on the market. As I mentioned in my previous analysis, breaking below the 1255/2 area had turned the short-term technical outlook to the downside. Recent price action makes me think that prices will have a tendency to retreat towards the daily Ichimoku cloud which currently sits around 1200, unless the bulls take over and pull the market back above the 1255/2 resistance.

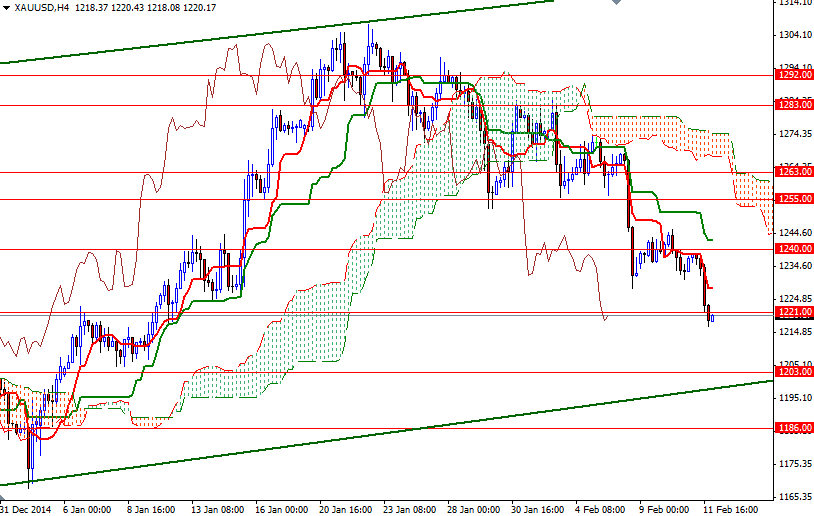

From an intra-day perspective, the key levels to watch will be 1216.50 and 1228/32. If the XAU/USD pair drops below yesterday's low, it is possible to see a bearish continuation to the next support level of 1210/08. Breaking that support would confirm that the bears are targeting the 1200 level. The bulls will need to take out the resistance at 1228/32 if they want to have a chance to make an assault on the barrier at 1240. Only a close above 1240 could give the bulls the extra power they need to reach the 1252 level.