Gold prices rose 0.32% on Wednesday as the dollar weakened economic data from the U.S. failed to beat market expectations and minutes from the Federal Open Market Committee’s January 27-28 meeting showed U.S. central bank official intend to keep interest rates extremely low for longer than previously thought. The Labor Department reported that its producer price index dropped 0.8% in January and figures from the Federal Reserve showed that industrial production edged up 0.2%. "Many participants indicated that their assessment of the balance of risks associated with the timing of the beginning of policy normalization had inclined them toward keeping the federal funds rate at its effective lower bound for a longer time", according to the records.

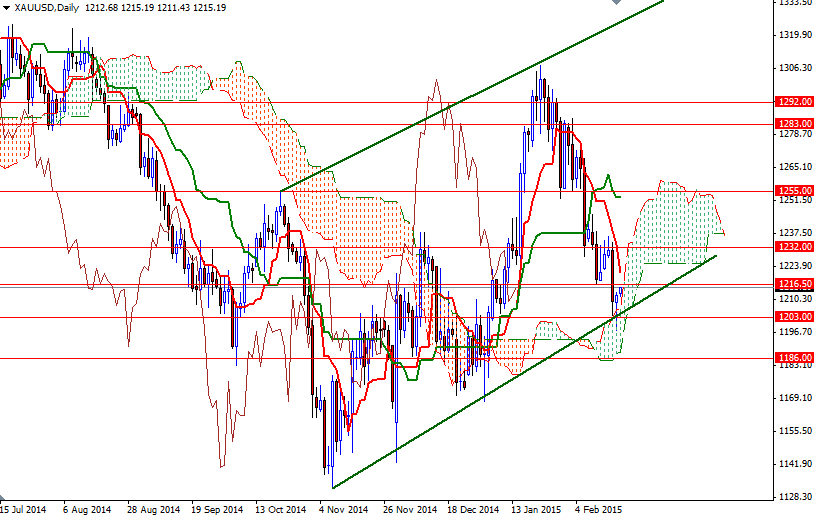

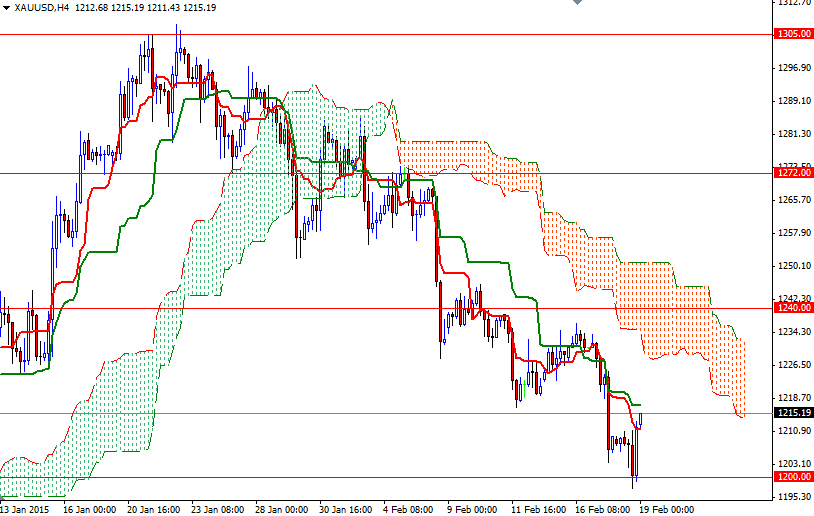

Although minutes provided little insight into when rates could rise, the Fed was more dovish than expected. The possibility of a delay in raising interest rates helped the bulls push prices, which had dropped to a six-week low of $1197.56 earlier in the session, higher and form a hammer. As I mentioned yesterday, a bunch of support levels converge in the 1200 - 1186 area (such as the ascending trend line originating in November, daily Ichimoku cloud and Fibonacci 61.8 so until the bears capture this fort, the downside will be limited.

However, the bulls will have to push their way through the 1216.50 - 1221.75 resistance so that they can gain enough traction to march towards 1229 - 1232. Once above that, the XAU/USD pair will be aiming for 1240 (the 38.2 retracement of the bullish run from 1131.96 to 1307.47). If the bears take the reins and the XAU/USD pair breaks below yesterday's low, then the market will probably test the 1186 level afterwards. A daily close below that would make me think that the market is ready to tackle the next strong support at 1170/66.