Gold prices rose for the first time in three sessions and settled at $1339.22 per ounce on concern that Greek debt negotiations will undermine the financial stability of the euro zone. Major stock markets fell on Monday after Germany signaled little willingness to compromise over bailout conditions. The new Greek government plans to reject some of the harshest austerity measures attached to Greece’s bailout loans but the euro zone doesn't want to bow to Prime Minister Tsipras' demands.

It appears that the market is caught between desire for safe-haven diversification and growing perception that the U.S. Federal Reserve is moving closer to raising interest rates. The precious metal tends to react positively to the fear factor but after the sharp drop on Friday, investors are hesitant to put more money into gold at the moment. Currently the XAU/USD pair is trading just above the 1240 level but the technical outlook remains mixed.

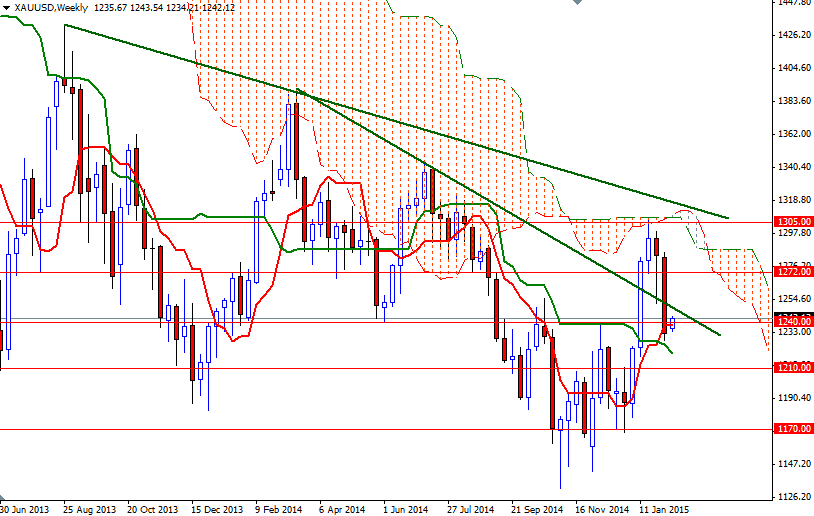

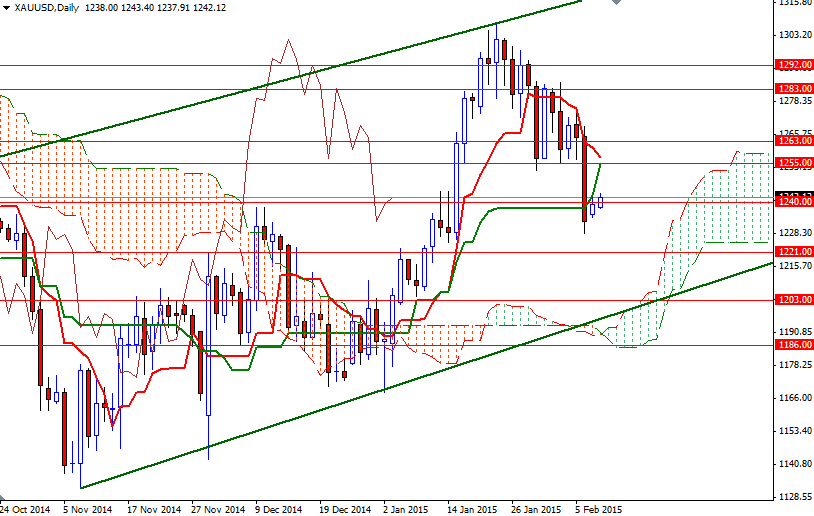

The weekly and 4-hour charts are favoring the bears at the moment but prices are still above the Ichimoku cloud on the daily time frame. The Chikou-span (closing price plotted 26 periods behind, brown line) line is moving above the daily cloud whereas it is located below the cloud on the 4-hour chart. If the bulls manage to hold prices above the 1240/38 area, they might have a chance to test the 1251 and 1255 resistance levels. I think breaching that barrier on a daily time frame is essential in order to test the critical resistance at 1263. If the bears take the reins and push prices below 1238, we could visit the supports at 1225 and 1221. Falling through 1221 will open up the risk of a move towards the 1210.