Although gold prices suffered a weekly loss of nearly 0.86%, the market had a strong month overall. Prices, which started the year at $1187.34 an ounce, advanced 8% in January, helped by the Swiss National Bank's decision to abandon its policy of intervening in currency markets to prevent undesirable strength of the franc and European Central Bank's quantitative easing. Political turmoil in Greece and lackluster demand for U.S. equities were also among the factors providing support for gold.

Last Wednesday the U.S. Federal Reserve painted a bullish view of the U.S. economy but the most recent GDP data indicates that the economy is not totally immune to an international economic slowdown. The Commerce Department's report showed that gross domestic product grew at a 2.6% annual pace during the fourth quarter, below expectations of a 3% rise.

The currency market maintains positive view for the American dollar but many gold investors don't see Fed lifting rates off of zero until June. That means the Fed’s plans to raise rates will maintain a constant pressure on gold, though it is a longer term worry for the bulls.

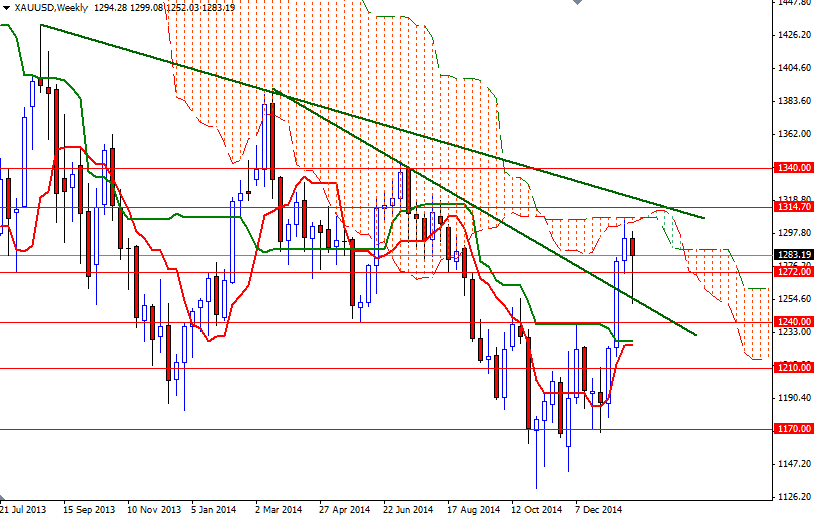

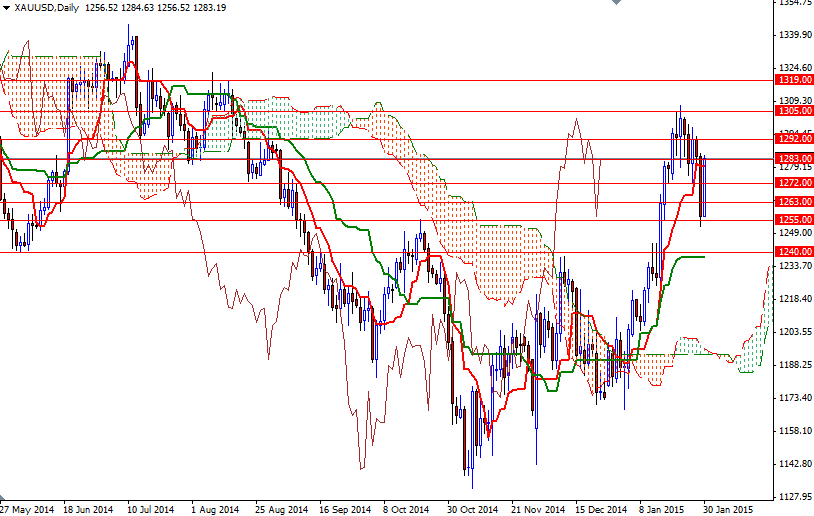

At this point, I would like to highlight the price movements in the past weeks. The XAU/USD pair broke above its short term descending trend line and run into a significant amount of resistance in the 1305/8 region as expected. This area which is occupied by the weekly Ichimoku clouds caused prices to pull back and test the broken line. As you can see, the market found support in the 1255 - 1240 area and bounced all the way back above the 1272 level. The fact that we closed above 1272 level tells me that we should continue to move higher, probably go all the way up to the 1340/4 area, which is the next major resistance on the longer-term charts. However, if the bulls run out of steam and fails to penetrate the weekly cloud, the market could go as low as $1240 level. That is a strategic support and the bears have to capture it if they are planning to make a fresh assault on the 1210 level.